The equity market selloff of late 2018 illustrates how hybrid securities can help protect investor capital. Between late August and Christmas eve 2018, Australian bank stocks declined by 13.3%. This is a very sharp decline and can make a significant difference to the long-term health of investment portfolio returns.

The Long Term Cost of Not Protecting Investment Portfolios

Investors holding a $1 million portfolio of bank stocks saw a $133,300 decline in their portfolio value. This is a very sharp decline. If you take that $133,300 of lost capital and invest it at the average annual return of the Australian stock market (11% per year), your investment grows to a little over $3 million dollars over 30 years. This highlights very clearly that downside protection of capital is as important for long term investment success as choosing the right investments.

What are Hybrids?

Hybrids are generally considered to be similar to fixed income investments as they usually represent an obligation to the issuer, pay a regular and defined income stream, and rank ahead of equity holders in the priority of claims. They typically have fixed maturity or conversion dates and have no voting rights. Hybrids can also similar to equity investments. Some dividend payments are discretionary, and may be franked. Some securities convert into ordinary shares. This may be at the issuer’s discretion or mandatorily when certain conditions are met. This results in more equity-like securities.

For diversified portfolios with attractive risk and return characteristics, several obvious reasons for investment in hybrids are apparent:

- Fixed income stream – Regular distribution payments that are preferential to dividends on ordinary equity;

- Reduced volatility – Enables investors to diversify their portfolios to include assets with blended debt and equity features;

- Quality issuers – Provides access to well known highly regarded companies;

- Equity growth participation or “optionality” – Provides investors with potential to participate in company growth with limited downside;

- Liquidity – ASX listed top tier hybrid securities provide investors with increased liquidity relative to other fixed income products;

- Taxation – Access to franked distributions;

- High yielding – Relative to term deposit products and senior debt.

The Downside Protection Quality of Australian Bank Hybrids

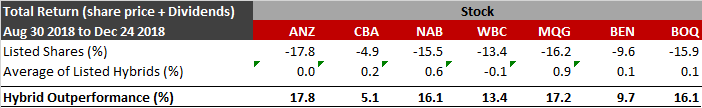

Bank shares declined by 13.3% as a group from late August to Christmas eve. Yet, the hybrids issued by the major banks actually rose by an average 0.3%. This is an outperformance of 13.6%, or a staggering 43% on an annualised basis over the underlying shares of the banks. The table below illustrates the relative capital protection hybrids can offer investors amid a volatile and declining stock market.

As an example, ANZ declined by 17.8% in total return (share price return plus dividends) in the period. By contrast, the convertible preference shares issued by ANZ (ANZPD, ANZPE, ANZPF, ANZPG, and ANZPH) did not decline at all as a group. Investors were 17.8% better off invested in the hybrids of ANZ than the underlying shares. Similar benefits were observed for other bank hybrids as the table shows.

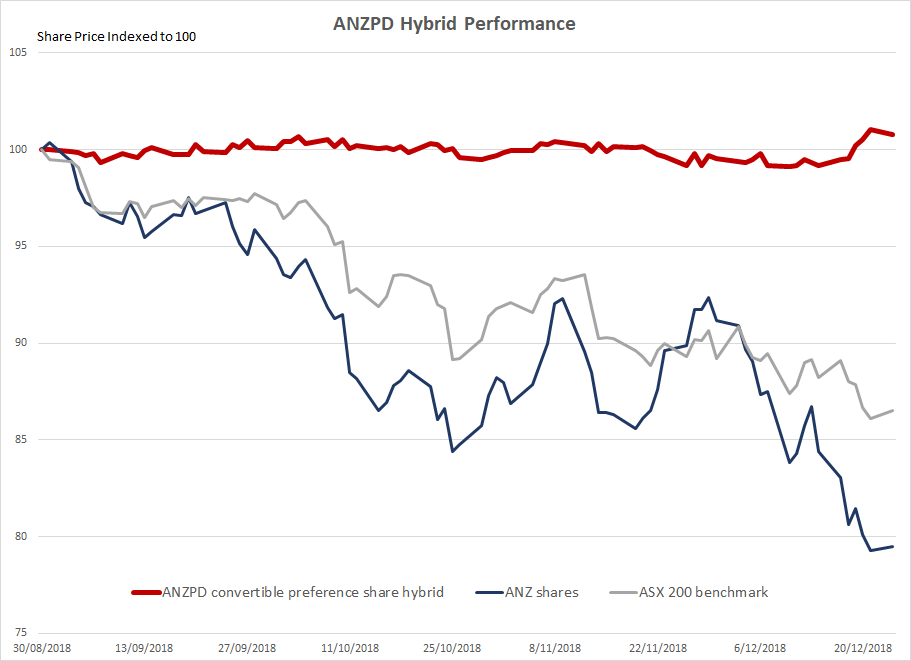

Over the same period, the chart below shows the ANZ share price, the ANZPD hybrid price, and the ASX 200 index, all indexed to 100 at the beginning. The chart shows the ANZPD hybrid in RED, ANZ shares in BLUE, and the ASX 200 in GREY. Two very important concepts about capital preservation are apparent:

- The ANZPD hybrid maintained its value; and

- ANZPD significantly outperformed both the underlying ANZ share price, and the ASX 200 stockmarket benchmark.

Hybrids can make a significant contribution to capital preservation in volatile times. They contribute to capital stability, help solidify regular distributions to assist with income maintenance, and protect your portfolio from unnecessary declines in long term performance. Our comprehensive knowledge of Australian listed hybrid securities and the fixed income markets can assist you make more informed portfolio decisions that contribute to investment success.

Gordon Anderson is a portfolio manager at Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Sign up to our newsletter. It comes out every week and its free!

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!