A recent report from Standard & Poor’s (S&P), the SPIVA report, has uncovered that over 80% of Australian fund managers have underperformed the index over 15 years. Investing in a managed fund is generally perceived as an easier way to invest. It can be a set and forget exercise where the investor does not need to monitor their investments. However, the convenience of a managed fund comes at a cost. Management fees can often be quite high. Often these fees are not justified because of the lack of performance by the fund manager. In this article we discuss reasons for why they may be underperforming and the differences between a stock broker and a fund manager.

Fees

Fund managers charge a management fee and performance fee when they return above the benchmark. Beating the market is a difficult exercise but with fees on top, this makes it more challenging. Investors are being charged a management fee regardless of whether the fund makes money or not. When it is tough to beat the market, management fees drag the returns down even further. Investors also have to bear in mind that they are not getting any advice from the fund manager. If an investor wishes to then seek out advice, then that is another fee to pay on top of the fund manager’s fees.

Conservative Approach

The job of a fund manager is heavily dependent on their performance. This encourages fund managers to take conservative decisions in fear of making a bad decision and losing their job and/or funds under management. This conservative approach contributes to their underperformance as fund managers are afraid to implement riskier trade ideas.

Value Investors Lose Out

The market currently favours momentum trading so this means buying stocks that have high return over the past three to twelve months and selling those that had poor returns over the same period. Fund managers who are value investors would find it hard to perform in this market. Value investors select stocks which trade at a price which is lower compared to their fundamental values. However, what we are seeing in this market is that value stocks are continuing to trade lower. They are cheap for a reason.

Diversification

Managed funds tend to hold sixty, seventy or more positions in different equities which is higher than the recommended number of twenty as the optimal number for diversification. We have previously written about diversification on our blog – https://fairmontequities.com/the-benefits-of-diversification/. For a fund manager to outperform a market, they need to hold few positions or be overweight in a few sectors. Overdiversification in a fund can cause underperformance.

Cash on hand

Fund managers are required to keep cash on hand in case clients want to redeem units or if the market fall and they want to buy stock at a cheap price. However when the market falls, investors panic and are more likely to pull their money out. This may cause fund managers to sell stocks at the worst of times to meet the redemption demands which may negatively affect the returns of the funds.

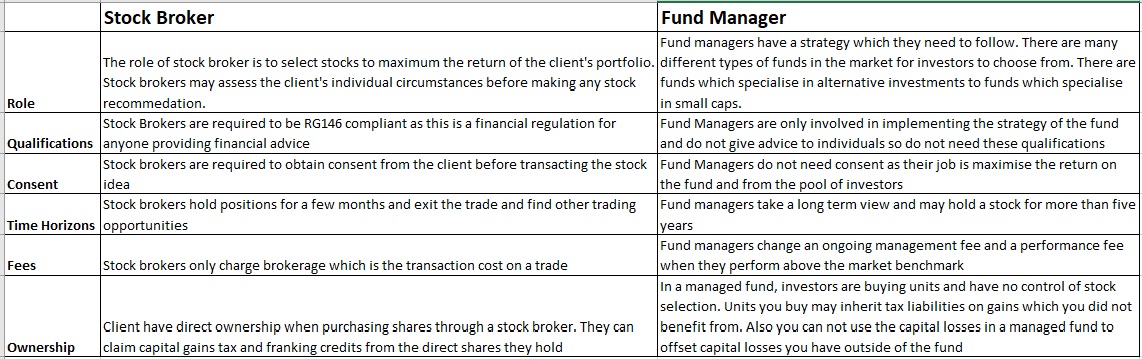

Differences between Stock Broker and Fund Manager

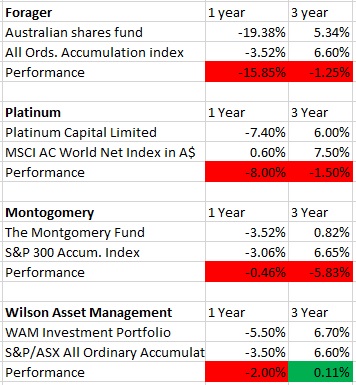

Fund Manager Returns

Lauren Hua is a private client adviser at Fairmont Equities.

Sign up to our newsletter. It comes out every week and its free!

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!