We recently reviewed Goodman Group (ASX:GMG) after the Company issued an operational update for the 3rd quarter of financial year 2020 (3Q20). This also contained commentary on the impact of COVID-19 on its business. The update highlighted the resilience of the property portfolio, as evidenced by: i) Ongoing strength in key financial metrics (such as occupancy and income growth), ii) Positive revaluations and iii) An unhinged path in the development pipeline.

But is this enough to offset the threat to earnings from cap* rates potentially rising, against the backdrop of a global recession and decline in prices for risky assets, as a result of the COVID-19 crisis?

About Goodman Group

Goodman Group is an integrated property group, with operations throughout Australia, NZ, Asia, Europe, UK, US and Brazil. The Company is one of the largest specialist fund managers of industrial property globally.

The Company derives revenue from four sources: Property rent, developments, investments and funds management. The Management division is the main driver of group earnings. Earnings from the Management division comprise investment management, including portfolio performance fees and property service fees. The Development division sources land and uses 3rd party builders to construct high-quality industrial assets and business parks, predominantly for 3rd party logistics providers and large retailers (both online and traditional).

Are earnings at risk from rising cap rates?

GMG’s earnings remain highly leveraged to cap rate movements. The significant cap rate compression over the last five years (of ~200-250 basis points across its regional portfolios) has been a key contributing factor to the improvement in GMG’s average development margin on cost.

The Company expects cap rates to remain stable for its portfolio of well-leased, high quality logistics assets. However, the possibility that cap rates begin to increase – or compress to a lesser extent that in previous years – given a backdrop of global recession and downward re-pricing across the spectrum of risk assets – poses a risk for GMG’s earnings.

Even a small decline in the cap rate (i.e. below that recorded over the last five years) would see GMG’s average development margin on cost decline from over 40% to 35-40%. While such margins would remain well above feasibility levels, there is nonetheless an impact on earnings as a result of lower on-balance-sheet development gains.

Fundamental View

On balance, we consider that there is a strong case for GMG to continue to trade on a premium rating. In particular:

i. The Company reaffirmed guidance for +11% EPS growth in FY20 to 57.3 cents per unit, and distribution of 30 cents per unit (which represents a payout ratio of ~50%). GMG has consistently covered distributions with operating cash flow and has utilised retained earnings to fund growth initiatives, which in turn has augmented EPS growth.

ii. Earnings momentum is expected to remain strong in FY21 with significant development and performance fee profits built up, as well as potential upside to Net Operating Income growth expectations of +3%. Further, the expected growth in Development Work in Progress, from $4.8b to $5.0b by 30 June 2020 provides visibility over GMG’s FY21 earnings outlook. Earnings growth in FY22 will be predicated on further growth in development activity and margins being maintained.

iii. Gearing is one of the strongest among listed peers. Gearing as at 31 December 2019 was 10% and at the lower end of the range in comparison to other listed A-REITs. Moving forward, the gearing level is expected to remain low, with the strong balance sheet position allowing the Company to pursue organic growth opportunities. These are likely to entail development restocking, as opposed to Mergers & Acquisitions. Further, there is substantial liquidity available and any form of covenant breach is considered unlikely.

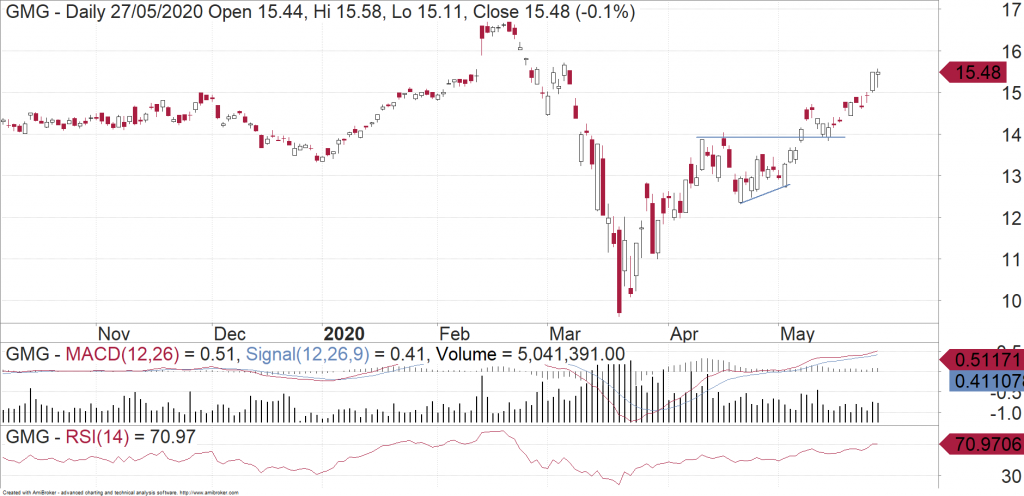

Charting View

After bouncing higher in late March – early April, GMG then consolidated the move by forming an ascending triangle. It then broke free of this on 7 May, retested the breakout, and is now heading higher again. GMG should continue to rally here. The next level of resistance is between $15.50 and $16.50.

* The capitalisation (cap) rate is the rate of return on a real estate investment property based on the income that the property is expected to generate.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!