The US midterm elections take place on Tuesday 6 November. Investors are keenly watching how that will play out as the results will affect the next two years of US economic policy.

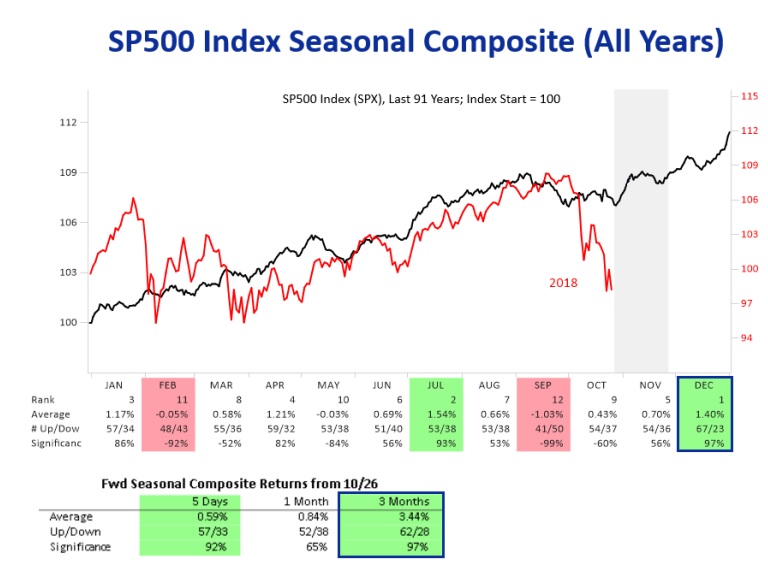

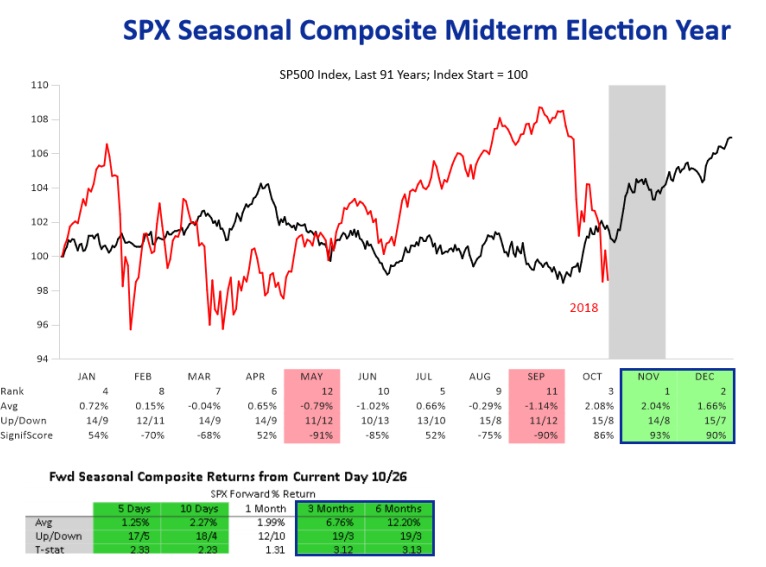

Below are two very interesting charts from Nautilus Investment Research. They give us an idea of what normally happens to the S&P500 in the run up to the end of the year, and what normally happens after the mid term elections. Essentially, markets usually rise during this time. Also bear in mind that we are now coming off a low base.

Our take is that we could see a similar situation to what occurred when US President Donald Trump was elected. Markets fell into the election but jumped the day after.

Despite jumping, it proved to be a good idea to go long as there was still plenty of upside to come.

The mid term elections are next Tuesday, 6 November.

A jump in the S&P500 would be a buy signal in our opinion.

Already our market is finding support at the levels we highlighted previously.

Stocks that could potentially do well would be:

- Growth stocks. This includes CSL, COH, BAP, ALL, ALU

- Commodities. Stocks that benefit from a strong economy and higher US dollar. I like BHP, FMG, SFR, WPL

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Michael Gable is managing director of Fairmont Equities.

Sign up to our newsletter. It comes out every week and its free!

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!