Shares in Auckland International Airport (ASX:AIA) have recovered quickly from its lows in March. Balance sheet risks have been removed and opportunism grows around restarting international travel. While AIA’s recent domestic passenger volumes trends suggest a faster-than-expected recovery in New Zealand air travel as COVID-19 restrictions ease, the extent to which the Company is leveraged to the recovery in international travel (which is the key profit driver for AIA) is crucial to the AIA investment case.

About Auckland International Airport

Auckland International Airport is the owner and operator of Auckland Airport, New Zealand’s largest international airport. Revenue is generated by various aeronautical charges (which are levied on a per passenger, aircraft landing and aircraft basis), and from commercial performance of retailing, car parking and property businesses. AIA’s aeronautical revenue is regulated by the New Zealand Commerce Commission.

The key profit driver for the Company are international passengers, given the high aeronautical fees paid by the airlines and greater portion of retail expenditure in the international passenger terminal, in comparison to domestic passengers.

Recent Results Reflect COVID-19 Impact

The result for the 12 months to 30 June 2020 (FY20) quantified the significant impact of border closures in response to COVID-19 in 4Q20. International passenger volumes were down 98% in that period and currently remain lower by the same extent. On the other hand, while domestic passenger volumes initially decreased by a similar level before recovering (to ~60% of pre-COVID-19 levels in July) as domestic travel was reintroduced (however, increased restrictions in NZ since mid-August have impacted the recovery).

The resultant sharp drop in aeronautical revenue (-47% in 2H20) flowed through to non-aeronautical revenue lines, with Retail revenue down 76% in 2H20 and car parking revenue down 49% with the partial recovery in domestic passenger volumes providing some offset.

Key Fundamental Considerations

Revenue & Margin Outlook Relies Heavily on Recovery in International Volumes

For AIA, Trans-Tasman passengers account for ~58% of international passengers and ~43% of overall passengers. The Company has indicated that it expects the Trans-Tasman travel to come into effect in early calendar year 2021, while Air New Zealand does not expect the Trans-Tasman travel until March 2021, at the very earliest.

Given the uncertainty about the extent and timing of a recovery for both short-haul Tasman & Pacific Island travel and long-haul international travel, AIA has suspended underlying earnings guidance for FY21. Also, dividends are suspended while covenant waivers are in place (until December 2021).

As international passengers are more profitable than domestic passengers, the international recovery lagging the domestic recovery will see a significant hit to AIA’s profitability, with total passenger volumes to recover faster than earnings.

Revenue growth for FY21 is expected to remain challenged, reflecting the decline in international passenger numbers (outweighing the recovery in domestic passenger numbers) as well the declines in retail, car parking and other transport activity. In particular, AIA has converted most terminal tenants to turnover-based rent.

EBITDA margin in FY21 is expected to recover (back towards 60%) as the Company implemented a range of cost-cutting measures in late FY20, including cuts to staffing, salaries and other expenses. As the recovery in revenue improves in FY22 (from a likely Trans-Tasman bubble, a further recovery in domestic passenger numbers and a steady contribution

from property income), EBITDA margin in FY22 is expected to continue to improve further.

How Well Leveraged is AIA to a Recovery in Passenger Volumes?

While the Company is strongly leveraged to a recovery in domestic (NZ) travel, we consider the degree of leverage to a recovery in international travel is more protracted. The protracted nature of the recovery in long-haul international travel globally is underpinned by factors such as worldwide government policy regarding the resumption of international travel, the likelihood that some capacity (~10-15%) has permanently exited the market and some structural changes to global travel are inevitable – including the availability of vaccines and global travel insurance. We assume that the recovery in long-haul international travel back to 2019 levels will likely occur in FY25.

When international borders eventually re-open, AIA is favourably leveraged to a recovery in international passenger volumes, relative to most airports in the Asia-Pacific region. AIA’s domestic passenger volumes were -71% in June (vs the prior corresponding period) and -39% in July (AIA turned EBITDA-positive in July), which is a sharper month-on-month recovery trajectory than observed even in many airports in China.

Balance Sheet Has Sufficient Flexibility

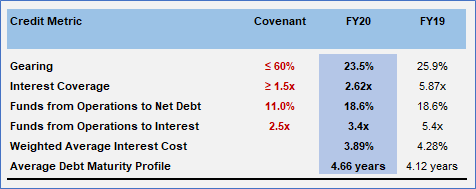

AIA has a strong balance sheet and has sufficient liquidity. In addition, refinancing risk has recently been reduced substantially, given that the Company has extended bank debt maturities and obtained waivers from bank lenders until 31 December 2021 (inclusive). Following the recent equity raising, the Company’s key credit metrics are comfortably ahead of covenant requirements.

Fundamental View

AIA shares remain an attractive play on the ‘travel recovery’ theme. However, the share price is now at a premium to market valuations, which average A$6.18 per share and range from A$5.95 to A$7.07. We also consider that trading in AIA is likely to be volatile, as travel restrictions ease and airline capacity recovers.

Greater visibility over border re-openings and a COVID-19 vaccine are likely to reduce the uncertainty and improve earnings visibility.

Charting View

The AIA chart is showing a nice set-up here. After consolidating across June – August, the shares got moving again and rallied from under $6 to $6.61 in early September. They then consolidated again by spending most of September trading under the June high. We have now seen it push higher again and we should now expect AIA to continue trending higher from here. Current levels are therefore a buying opportunity.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!