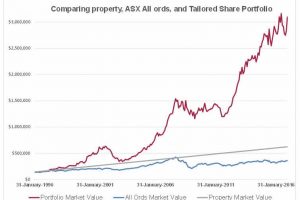

Shares vs Property – Which produces greater returns?

Property has been a major source of wealth building over the last couple of decades. And has been the vehicle of choice for “Mum & Dad” investors. But is this growth sustainable? And how does Property as an investment stack up against Shares in the medium to long term? The answer to the first is while historically property prices have steadily increased, this is by no means guaranteed. Outside Sydney and Melbourne, property prices have fallen significantly in Perth by …

Read MoreShares vs Property – Which produces greater returns?