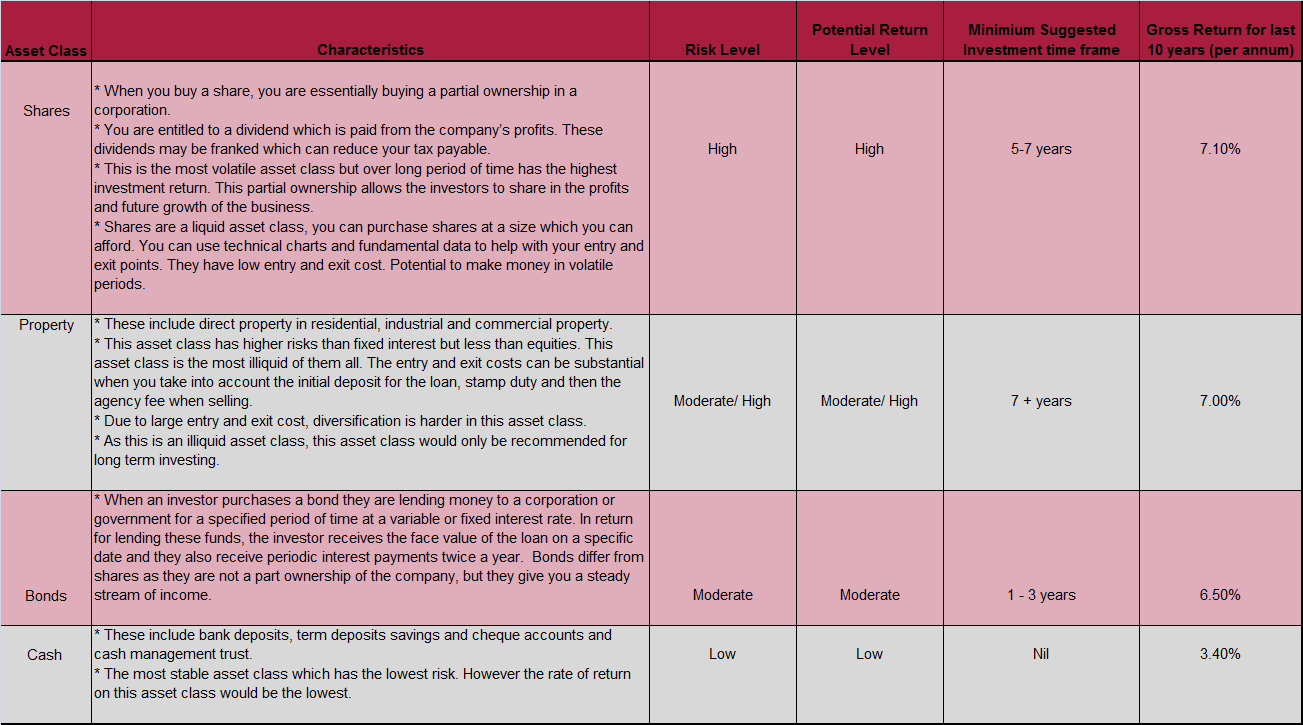

There are a number of asset classes out there for investors to choose from. Below is a table showing the most common. From the table, you can see the returns of shares and property are very similar with shares returning 7.1 % and property returning 7% per annum over a 10 year period. The difference of the two asset classes is the liquidity of two. Substantially higher funds are required for property as 10% or 20% deposits are needed to secure a loan. Due to the larger cost involved in property, it is much harder to diversify. With shares, a smaller outlay is required and with the same amount as a deposit on a home, you can diversify and purchase stocks in different industries. It is much easier to enter the share market than the property market with housing affordability being an issue in Australia at the moment.

Shares are also more liquid than property so you can buy and sell in a shorter term frame and potentially profit in volatile markets. Also tools such as technical and fundamental analysis can assist in selecting entry and exit points of a trade. The cycle of a property market is longer so these entry and exit points will be of a lengthened period. Greater holding periods are suggested for property due to its illiquidity.

If you have a SMSF, diversification may be important to you and if this is the case, shares could be a more suitable asset class. The smaller entry and exit costs and liquidity will enable the investor to purchase different shares in diverse industries and balance the risk of the overall portfolio.

Bond and cash are lower risk asset classes which have stable income streams but have lower return expectations.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email Michael Gable directly at michael@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.