We recently researched Technology One (ASX:TNE) in The Dynamic Investor after a period of weakness in the shares appeared to present an entry opportunity. Since our report, the shares have recovered well. Accordingly, we assess whether there is scope for further upside from current levels.

About Technology One

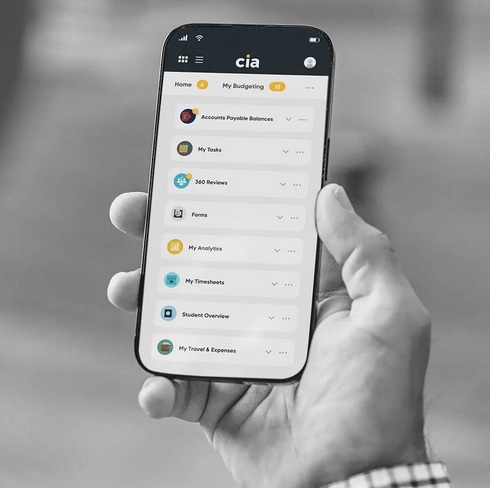

TNE is Australia’s largest enterprise resource planning (ERP) Software as a Service (SaaS) provider. The Company is the only SaaS provider with a fully integrated ERP suite and its entire enterprise suite is delivered on mobile devices. There are currently 15 products onto the new cloud native Ci Anywhere (CiA) SaaS platform. Customers use TNE’s SaaS solution, as the benefits include cost savings, scalability, security, and anywhere-anytime access. It also allows agility and speed to market of new products. These customers have hundreds of thousands of users, making TNE’s the largest ERP SaaS offering in Australia.

Around 85% of revenue is generated from the government, education and health sectors (or ‘verticals’), which are highly defensive and where the Company has a customer retention rate of +99% and very low customer churn rate.

Key Fundamental Drivers

Annual Recurring Revenue Target Brought Forward

TNE reported Total Annual Recurring Revenue (ARR) of $392.9m as at 30 September 2023 (FY23), which was up 23% compared to FY23. Total ARR growth continues to be driven by growth across all verticals, with five of the six verticals reporting ARR growth ranging from 18-32%. The vast majority of overall ARR is SaaS ARR.

As we had expected, the Company has brought forward its SaaS ARR target of $500m by one year, to FY25. Based on the ARR of $392.9m at the end of FY23, growth of ~13% per annum (on a CAGR basis) would be required to reach the $500m target by FY25.

Is the ARR Target Achievable?

The required growth rate of +13% compares to TNE’s historical CAGR of 18% per annum, or its medium term NRR target range of 115-120%, which doesn’t include any contribution from new customers. As such, the revised goal is considered easily achievable and if one assumes that the actual CAGR over this period is below the historical CAGR of 18% per annum, then ARR of ~$540m is achievable by FY25.

We consider the ARR target is also achievable from the viewpoint that:

i. The new ‘SaaS+’ offering is gaining faster traction than expected. The ‘SaaS+’ offering generates a higher ARR (around +40%) compared to traditional deals. In addition, TNE has executed well on transitioning its customer base to the cloud and driving incremental cross-sell.

ii. There was a strong uplift in ARR from the UK business (+52% to $26.5m), which was a positive surprise. Local Government and Education customer wins appear to validate TNE’s recent investments into product localisation and sales. Favourable competitive dynamics present an opportunity to win share.

Margin Target Retained

The Company reported a Profit Before Tax (PBT) margin of 30% in FY23. TNE has retained its 35% PBT margin target “in the next few years”. We assume this means FY26. On balance, we consider that the expansion in PBT margin over the next few years is underpinned by several factors:

- Continued run-down of legacy costs of running both on-premise and SaaS support systems.

PBT margin is expected to benefit from the incremental higher-margin SaaS+ ARR. - The Company is transitioning its cloud customers that are using original Ci products onto the new CiA platform. This transition is to ensure the best customer experience and enable TNE to cross-sell new cloud-native products. At present, ~100 customers are fully live on CiA (out of ~1200 total cloud customers).

- The R&D investment is mainly in growth platforms, including SaaS+, App Builder, Digital Experience Platform. Further, while R&D expenditure is likely to increase, the Company can still generate solid PBT growth (+15%) over FY24/25 while doing so, given the strong revenue trends.

Balance Sheet Position Remains Strong

The Company is well funded with a net cash position of >$220m as at 30 September 2023. The strong balance sheet position provides TNE with the opportunity to consider acquisitions as well as capital management optionality. The latter includes share buybacks, or an increase in dividend payments. Over the short-term, TNE could continue paying special dividends, given its track record of doing so. However, this is subject to TNE undertaking any Merger & Acquisition activity.

Fundamental View

The stronger share price since our recent report now see the shares trading on a 1-year forward P/E multiple of ~41.5x. In context, this is at the lower end of the trading range over the last four years (~37-47x). Over this period, TNE shares have traded at a premium to its historical P/E multiple. The latter reflects: i) A recurring revenue profile (>90%), ii) Low churn rates (typically <1%), iii) A highly cash generative business model, iv) A net cash balance sheet, v) A track record of consistent performance and vi) Achievable medium-term targets for ARR and margin.

The current 1-year forward P/E multiple compares to a highly attractive EPS growth profile of +17% over FY23-26 (on a CAGR basis). This presents a more attractive from a risk-reward perspective. The main reason for this is that near-term catalysts from Merger & Acquisition and further contract wins in the UK have now emerged.

Charting View

The past several months has seen TNE trade in a range between about $14.50 and $17. In November, the shares rallied up to the old high near $17 but they were then sold down fairly decisively. This is not a great sign. We are also seeing the shares languish at the lower to middle end of the range, which is also a concern. However, with a tight stop near $14.50, the stock is a tentative buy here with a view that it could at least head back towards the top of the range again. A fall under $14.50 would be a negative sign, so if you wait to see if $14.50 holds or not, then a break under that would allow investors to pick it up at cheaper levels towards the mid $13’s.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!