We have long considered CSL Limited (ASX:CSL) to be a core holding in stock portfolios. The shares recently have retreated from their highs. This is on the back of product supply issues as well as a shift in investor preference away from healthcare stocks. Here we assess the prospects for a recovery in the share price.

About CSL

CSL has two operating segments: CSL Behring and Seqirus. The CSL Behring segment (which accounts for >85% of group revenue) provides plasma-derived and recombinant products. It also operates plasma collection networks through CSL Plasma. CSL Behring provides treatments for people who are living with conditions in the immunology, haematology, cardiovascular and metabolic, respiratory, and transplant therapeutic areas.

The Seqirus segment manufactures and distributes non-plasma biotherapeutic products and develops influenza-related products. Seqirus is one of the largest influenza vaccine providers in the world.

Market Share in CSL Behring Well Positioned to Accelerate

By way of background, Immunoglobulins (IG) are the main driver of (and contributor) to sales within the CSL Behring segment. Immunoglobulins are comprised of:

- Intravenous immunoglobulin (IVIG). This is a solution prepared from large pools of human plasma collected from several thousand blood donors. It contains the typical IG antibodies found in the normal population.

- Subcutaneous Immunoglobulin (SCIG) infusions. These are given by slowly injecting purified immunoglobulin into fatty tissue just underneath the skin and can be given at home.

IG reported sales growth of 22% in FY20. This was underpinned by strong growth in Privigen and Hizentra. These two products combined account for over 50% of CSL Behring’s revenue. Importantly, CSL’s growth rates in IG were above market growth rates, as a result of favourable mix and pricing.

The Company has now delivered two successive periods where Hizentra (an SCIG product) has outperformed Privigen (an IVIG product). This mix shift is positive for margins, as Hizentra has a higher margin than Privigen. Pricing trends are also positive, given that pricing has increased by around the rate of inflation (CPI) in the US and more than CPI in some European markets.

The sufficient availability of plasma inventories, further positive mix changes (i.e. shift to SCIG) and price rises support expectations for double-digit IG sales growth in FY21. This is despite challenges related to plasma supply (discussed in further detail below).

Seqirus Segment to Benefit From COVID-19 Vaccines

Seqirus is an important segment from the viewpoint that it has a more aggressive revenue and earnings growth outlook relative to the CSL Behring businesses. In FY20, Seqirus comfortably exceeded guidance and earnings growth in FY21 is expected to benefit from rising COVID-19 vaccination rates.

The medium-term outlook for Seqirus’ revenue and earnings is underpinned by the likelihood that the COVID-19 pandemic will promote a sustained increase in flu vaccination rates over the next 2-3 years. On the back of this, CSL has recently signed a Heads of Agreement with the Australian Government to supply 51 million doses of the University of Queensland’s COVID-19 vaccine (V451). Distribution is scheduled for mid-2021.

Separately, CSL & AstraZeneca (AZN) have also signed a Heads of Agreement for the manufacture & distribution of 30 million doses of AZN’s COVID-19 vaccine (AZD1222). This is scheduled for shipping in early 2021, following successful clinical trials. Both of these agreements present an opportunity for the Seqirus segment.

Plasma Costs Are a Key Variable for Profit Guidance

One of the major impacts of the COVID-19 pandemic on the plasma industry has been a decline in plasma donations in the US. The US provides the majority of the raw material for the plasma industries finished products. The decline in plasma collections in the final quarter of FY20 is expected to negatively flow through to revenue in 6-9 months, as well as increase collection costs.

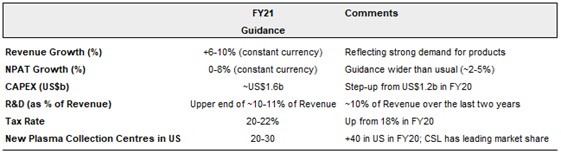

These factors have impacted FY21 guidance for Net Profit After Tax (NPAT) growth. The Company has guided to of 0-8% growth in FY21, which is an unusually wide range and reflects the uncertainty over near-term plasma collections. A quick recovery in collections is not expected despite the rise in unemployment. This is due to the potential for increase in COVID-19 infection hotspots and continued social distancing requirements. It is likely that the Company will be in a position to tighten the guidance range by the AGM in October.

Plasma collection trends over coming months will be key in assessing potential outcomes in relation to FY21 earnings. Trends over the December 2020 quarter and into early calendar year 2021 will shape the outlook for FY22.

Once plasma collection trends improve, CSL is better placed to continue to grow plasma collections at a faster pace than the rest of the industry (thereby increasing its market share). This is because it has aggressively invested in expanding the collection network. It also has the highest number of collection centers in the US.

Fundamental View

CSL’s high (but undemanding) P/E multiple of ~42x is justified given CSL’s strong market position in a niche industry that has robust fundamentals. In particular: i) Strong demand from the key IG products (with growth in IG was above market), ii) Potential to gain market share in plasma collections once collection rates normalise and iii) A strong balance sheet that allows the Company to fund all of its CAPEX and R&D expenditure requirements, as well as maintain a dividend payout ratio 45% without having to draw down debt.

We consider product supply risk to be a short-term issue, with the Company still expected to generate double-digit EPS growth over the medium term. The key upside risk to FY21 earnings is plasma collections returning to normal quicker than expected. There is also the potential for the Company to generate further cost efficiencies given that operating costs over the last two years have been elevated.

Charting View

CSL has held up better than the overall market since the start of the year, but it has under-performed in the last few months. However, the longer term chart is still in an uptrend. In terms of the short term, we can see that after bouncing strongly in April, it then eased back to retest the March lows. That downtrend from April – August was then broken on the back of a strong full year result. The shares have drifted back again towards the breakout zone, but now we are seeing some support come back into CSL. With CSL shares now looking like they are on the move again, these are the levels where it is worth buying.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!