We recently researched Iluka Resources (ASX:ILU) in The Dynamic Investor after the Company released its Activities Report for the September 2022 quarter (‘3Q22’). While the report itself was broadly in line with consensus expectations, the more relevant factors underpinning any investment decision are: i) The pricing environment for both zircon and high-grade titanium dioxide and ii) Likely newsflow on the progress of several projects.

With the shares having rallied strongly since our report only a week ago, is there still value at current levels?

About Iluka Resources

Iluka Resources is a leading producer of zircon and the high-grade titanium dioxide feedstocks rutile and synthetic rutile. ILU has projects and operations in Australia and a globally integrated marketing network and has also established a significant position in rare earth elements. ILU’s products are used in an array of applications including technology, construction, medical, lifestyle and industrial uses.

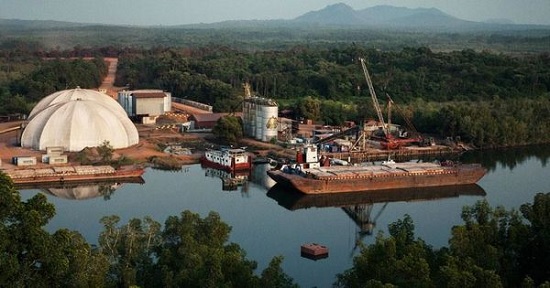

The Company (which has a 31 December balance date) completed the demerger of Sierra Rutile on 4 August 2022. It also holds a 20% stake in Deterra Royalties (ASX: DRR), the largest ASX-listed resources focused royalty company.

Key Fundamental Drivers

Elevated Pricing Expected to be Maintained Into 2023

In recent quarters, the Company has benefited from stronger pricing for zircon, rutile and synthetic rutile. While pricing strength continued in 3Q22, it appears to have peaked.

In light of market volatility and in spite of weakening demand conditions, ILU has communicated to customers that it will keep zircon prices flat for the next six months. As was the case in 3Q22, zircon sales for 4Q22 are fully contracted, reflecting the current tight zircon market. In addition, all of ILU’s rutile and synthetic rutile are sold out for the remainder of the year. While rutile prices have come down substantially from mid-2022 highs, they remain elevated versus historical averages and long-term assumptions of ~US$1,150/t.

The challenge in maintaining stable zircon pricing for the next six months is that spot prices continue to deteriorate and are now below benchmark prices for the major producers. As such, should demand continue to deteriorate, ILU may have trouble maintaining a steady price in 1Q23 when sales are not contracted.

Despite weakening demand, there is potential for prices of both Zircon and high-grade titanium dioxide (Ti02) feedstock to remain supported into 2023.

Several Projects Offer Near-Term Catalysts

The 3Q22 Activities Report contained updates on various studies in ILU’s project pipeline that present key near term catalysts. The most advanced of these is the Eneabba Phase 3 Rare Earths Refinery Project – a fully integrated refinery for the production of separated rare earth oxides at Eneabba, Western Australia. Iluka announced its final investment decision in April 2022 and has since announced a strategic partnership with Northern Minerals (ASX:NTU) for the supply of all available concentrate from Northern Minerals’ Browns Range project. The Northern Minerals Browns Range project is awaiting a definitive feasibility study (DFS), with first production expected in 2026.

Concentrate from Browns Range will be a valuable additional source of feedstock for Iluka’s Eneabba rare earths refinery. It will be a significant contributor to establishing the refinery as a long-term producer of highly valued heavy (dysprosium and terbium), as well as light (neodymium and praseodymium), permanent magnet rare earth oxides (REOs). Construction works on the camp upgrade are underway, with tendering for a new operational camp in progress.

Other projects include:

i. Balranald – a rutile-rich deposit in the northern Murray Basin, NSW. The Company expects to complete the DFS for Balranald in late 2022, with the Board likely to consider a final investment decision in February 2023.

ii. Wimmera – Test work is continuing, with the aim of completing the preliminary feasibility study (PFS) at the end of calendar year 2022. The rare earth bearing minerals within the Wimmera deposits are very similar to Iluka’s Eneabba stockpile, though with more xenotime (which contains higher levels of dysprosium and terbium), and are a potential future source of feedstock for the Eneabba Rare Earth Refinery.

iii. Synthetic Rutile Kiln 1 Restart, Western Australia (SR1) – Site refurbishment activities have progressed in line with cost and schedule with start-up remaining on track for 4Q22. The Company has received significant interest from both existing and new customers regarding offtake of synthetic rutile from SR1.

Fundamental View

Following the re-rating in the shares since our recent report, ILU shares are now trading on a 1-year forward P/E multiple of ~10x, which we do not consider to be overly demanding. Importantly, catalysts for ILU over the short-to-medium term include:

• The potential for prices of both Zircon and high-grade titanium dioxide (Ti02) feedstock to remain supported into 2023, which in turn may lead to upgrades to EPS estimates, which at present factor in a descending profile that is more pronounced in FY24.

• The potential for the market to begin factoring into ILU’s earnings estimates and valuation the additional value from ILU’s current project pipeline, in particular:

i. Completion of the DFS for Balranald (expected in late 2022) and as well as a Final Investment Decision (expected in February 2023), especially in light of the remaining mine life at the Jacinth/Ambrosia project.

ii. Volumes from the Wimmera project, with the PFS targeted for the end of calendar year 2022.

Charting View

ILU had been consolidating back in a clearly defined channel since peaking in August. At the start of this week, it broke higher, triggering a buy signal and leading to a rally up towards the August high. Now that is getting close to the August high, it is too late to chase it here. If we can see it consolidate by moving sideways for a few days or so, then that “cooling off” would be the right time to buy. A sideways consolidation would then set it up for another strong rally. Any sharp pullbacks from here would be a negative sign.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!