Xero (ASX:XRO) recently announced a cost reduction strategy that which helped cause a rally in the share price. Having been in steady decline since January 2022, we assess whether there is scope for further recovery in the shares. This is given that future earnings growth appears to be better supported by a leaner cost structure.

Overview Of Xero

Xero is a New Zealand-based software company that has developed cloud-based accounting software for Small-to-Medium Enterprises (SMEs) and accounting practices. Since listing in NZ in 2007, the Company has expanded into Australia, the UK, the US, SE Asia and South Africa.

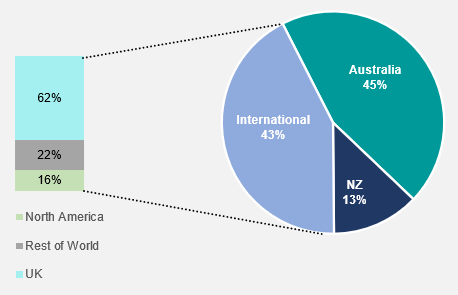

Revenue is reported across five geographical regions of exposure. The largest is Australia, which comprises 45% of group revenue. Aside from the exposure in major markets – North America, UK and NZ – the Company also sells its software in other markets which it classified as Rest of World. Though the geographical breakdown for this is not disclosed, however these are likely to include countries such as Singapore, Hong Kong and South Africa.

Key Fundamental Drivers

Cost Reduction Strategy to Support Margin Expansion

Shortly after the new CEO Sukhinder Singh Cassidy commenced on 1 February 2023, the Company announced that it aims to reduce headcount by 700-800 roles or ~15% of the full-time employee base. In percentage terms, the propose reduction is broadly in line with the average layoffs across the technology sector recently. The Company also re-affirmed cost guidance for FY23 to be at the lower end of 80-85%.

The proposed headcount reduction is expected to result in an operating expense ratio of around 75% in FY24, from 80% in 2H23. This assumes some of the costs are reinvested in the business. In context, XRO has a large cost base, so these changes are expected to result in FY24 estimates for net profit after tax increasing by ~50% to NZ$126m.

The extent of the proposed headcount reduction (~15%) is unsurprising given that: i) Revenue per headcount has been in decline since FY19, ii) Growth in FY24 is expected to slow next year due to delays to the rollout of Making Tax Digital (MTD) software, as well as softer macro conditions, iii) XRO’s headcount has grown organically at ~22% over the past three years on CAGR basis, and iv) Record low job vacancies, according to reported Xero LinkedIn Job Vacancies.

Revenue Growth Largely Unaffected

A key question is the extent to which the cost reductions would impact XRO’s revenue growth, which overall point to a muted impact, thereby offering the potential for significantly more operating leverage. Firstly, most of the cost changes are staff related and are likely to come predominantly from non-revenue generating areas.

Secondly, international subscriber growth is likely to remain positive but mildly moderate with the reduced investment. The impact is more muted given that XRO generates a lower return on customer acquisition costs for its international operations in comparison to its operations in Australia & NZ, given that international markets are currently less efficient than the more mature Australia & NZ markets.

Balance Sheet Capacity Remains – But Acquisitions Likely on Hold

The Company held a net cash position of NZ$24m as at 30 September 2022. This declined over the course of the previous year (NZ$51m as at FY22 and NZ$125m as at 1H22). Nonetheless, the balance sheet remains in a strong position. As at 30 September 2022, XRO had liquidity of NZ$1.1b (including net cash) which was broadly unchanged from the NZ$1.2b available as at 31 March 2022.

The previous management had highlighted that in terms of potential Merger & Acquisition opportunities, it would focus on acquisitions and partnerships in the North America region, which we expect to remain the case, as alluded to above. However, given that the recently-announced cost reduction program highlights a focus on profitable growth over scale, further Merger & Acquisition opportunities may be placed on hold.

Fundamental View

Notwithstanding the recent recovery in the shares, at current levels, Xero is trading on a 1-year forward EV/sales multiple of ~9x. This is still at a significant discount to the 6-year average of ~12x and at the low end of the trading range over this timeframe.

While there are investor concerns about the pace of subscriber growth under a leaner cost structure, we see scope for a further re-rating in the shares over the short-to-medium term. There is upside risk to margin expansion beyond FY23 given that the Company has several options available to dial down expenses in geographies/capabilities where revenue may be impacted. Further, XRO retains strong pricing power (given the structural tailwinds driving cloud accounting adoption globally) that can continue to mitigate any impact from weaker subscriber growth, which is currently only limited to the UK and North American markets.

Further, the stabilising interest rates backdrop and improving US inflation data are likely to support a rotation back into high-quality growth stocks like XRO in the immediate term.

Charting View

Xero seems to have formed a base. We have seen higher lows since November and the start of February saw it break above a major resistance level near $75 on good volume. It then eased back to retest that breakout before rallying again at the start of March. The gap up in early March on strong volume looks like a “breakaway gap” and XRO should now trend higher.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!