Atlas Arteria (ASX:ALX) is a stock we have successfully recommended in the past and we recently revisited the fundamentals to assess the key value drivers for the stock. These are the outlook for distribution payments over the medium term, traffic performance and the potential outcomes from the decision undertaken last year to internalise the management of ALX.

About Atlas Arteria (ALX)

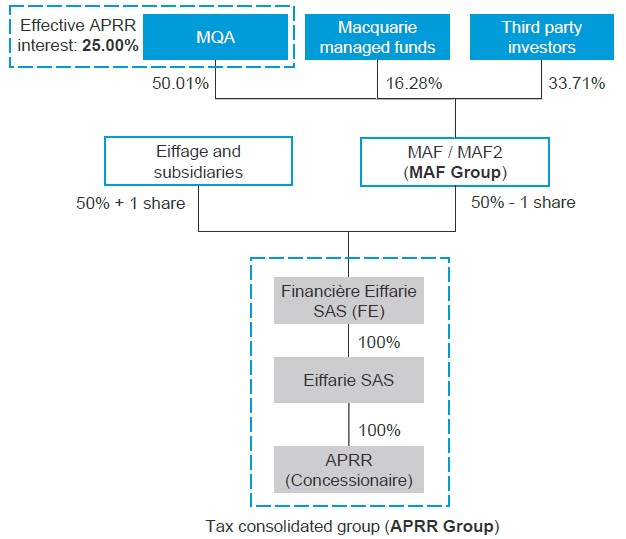

Atlas Arteria, formerly Macquarie Atlas Roads, holds an interest in a portfolio of tollroad assets located in Europe, US and Germany. The main asset is a 25% interest in European tollroad operator Autoroutes Paris-Rhin-Rhone APRR2. This is wholly owned by Eiffarie, a consortium held jointly by Eiffage (A European construction and concessions group), which has a majority interest, and Macquarie Autoroutes de France (MAF2), which is an investment fund managed by Macquarie. APRR is a 2,323km motorway network located in the east of France and is second largest motorway network in France and the fourth largest in Europe. APRR comprises three concessions, the major one being the APRR Concession. Other assets include:

- The Dulles Greenway: A 22km tollroad located in Loudoun County, Virginia (US). Dulles Greenway is now 100% owned by ALX after the Company, in February 2017, exercised its pre-emptive rights to acquire the remaining 50%.

- The Warnow Tunnel: A 2.1km tollroad and tunnel under the Warnow River in Rostock (Germany).

Internalisation of Management

In May 2018, the Company decided to internalise the management of ALX, which was previously undertaken by Macquarie Group fund MEIF2. ALX’s new management team will assume full management of ALX from 1 April 2019. As part of the restructure, Macquarie fund MEIF2 is seeking to exit its remaining ~7.8% stake in the APRR (via MAF), with the sale needing to pass through the pre-emptive sales process available to remaining investors in the MAF structure (including ALX). Please refer to the diagram below which illustrates the complex structure underpinning the Company’s interest in APRR.

A restructure of the shareholding offers the potential for ALX to exercise pre-emptive rights to acquire MEIF2’s interest in APRR. There are two potential scenarios that could be attractive to ALX. Firstly, in the event that Eiffage allows the collapse of the structure, this would improve ALX’s corporate appeal, as the current structure is currently considered complex enough to prevent corporate activity. Secondly, in the event that ALX and the other MAF2 shareholders fund the acquisition of the MEIF2 stake, this would be yield accretive for ALX investors as the majority of the stake can be debt financed and add to the distribution paid through MAF2.

Distribution Outlook

The Company has reaffirmed FY19 distribution guidance of 30.0 cents per share. This represents a 25% increase on the distribution paid for FY18. The guidance for a 25% rise in the FY19 dividend to 30.0c reflects an expected 10% increase in cashflow from APRR, but a flat overall cashflow for the group. While there is little risk to this distribution payment, there are a number of factors which are likely to influence distribution payments in FY20 and FY21.

i. The French government is currently reviewing the previously-legislated corporate tax rate reduction from 2019 to 2022, in order to help fund policy concessions to the Yellow Vests. While only speculation at this stage, there could be a one year pause in the decline in the corporate tax rate decline. The proposed reduction was for corporate tax in 2019 was from 33.3% to 31.0%, however, discussions on a potential tax rate reduction appears to be have been postponed/delayed. If revised or postponed, APRR distributions could be impacted, however this is likely to impact the FY20 distribution and not the FY19 distribution.

ii. There is potential upside to distribution payment in FY20/21 as a result of the removal of mandatory debt amortisation following the refinancing of the Eiffarie bank debt facility.

iii. There could be an additional contribution to the FY21 distribution from the Dulles Greenway, which is contingent on Dulles Greenway passing equity lock up tests in FY20 in order to pay distributions in 2021. However, this remains highly conditional on traffic performance stabilising in FY19. A key factor in the first dividend payment occurring in FY21 is that ALX are seeking a long-term tolling price path. As this requires legislative measures, establishing Greenway’s long-term tolling path is unlikely to be resolved before 1Q20.

Fundamental View

ALX is well-managed Company with a track record of growing distributions. At present there are a number of potential catalysts that could provide upside to current consensus distribution forecasts. These in turn would be a major catalyst for the stock. Another catalyst for the stock is the completion of the internalisation of the management of ALX, which makes the Company a more appealing takeover target. This is given that a key element of the discussions between the relevant parties is creating a more simplified structure. We have typically seen ALX trade well of the back of any macro-related, or broader-market, weakness.

Charting View

ALX had a great run during January and February, as it managed to push to new highs. It is now consolidating that move near the 2018 high. We can see ALX finding some support here in the high $6’s. However, it appears as though the 2018 weekly high near $7.15 is providing a bit of resistance. At the moment ALX is stuck in a narrow range. A break past resistance near $7.15 would trigger a buy signal and ALX would therefore have momentum to continue heading higher. A break of support near $6.80 however would see it possibly fall towards the next line of support near $6.50. However, a bounce off current support levels would be an early indication that ALX may attempt a move through $7.15.

Michael Gable is managing director of Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!