Higher interest rates are actually bad for bonds as it means lower bond prices. It is a confusing concept to understand so here is a simplified explanation. Bond yields are monitored by equity investors as it can impact the share market and reflect the direction of the economy. We have written about this on the following blog posts:

Why rising bond yields is bad news for the stock market

What bonds can reveal about the share market

How bonds work

A bond is a fixed income product where an investor lends money to a corporate or government organisation over a period of time. These firms issue bonds to raise money to use for various reasons. The issuer of the bond is obligated to pay the loan back at a specific date. They also pay the investor periodic interest payments, usually twice a year. This payment is called the coupon payment. At the maturity date, the company pays back the face value. Bonds can be traded on a secondary market such as the Australian Securities Exchange. The capital value of a bond can rise or fall depending on the current interest. The bond yield represents the return an investor will receive by holding the bond.

How an increase in the interest rate is a negative for bond holders

The reason why bond prices decrease as bond yields rise can be demonstrated by this example. If a 10 year old corporate bond is issued with a coupon rate of 3% and you invested $1000 you would get interest of $30 a year ($1000*0.03). If a year later interest rates rise and the same company issues a new bond with a interest rate of 5% then the new bond holders can receive an interest payment of $50 ($1000*0.05). The bondholder of the 3% bond will find it difficult to sell the bond in the market when new bonds issued are paying 5%. Hence the 3% bond holder will need to decrease their bond price to make up for the difference in interest payments. If the 3% bond is sold then the new owner will earn 3% in interest as well as some capital appreciation from the reduced bond price.

As you can see in the above example bond holders have to sell their bonds at a discount if interest rates rise and investors can get a better yield from newer issued bonds.

Difference between the bond yield rate and the coupon rate

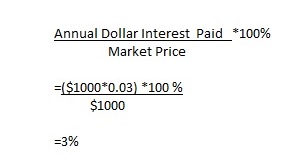

A bond’s coupon rate is the interest rate it pays the bond holder annually. The bond yield is rate of return it generates. If a $1000 bond with a coupon rate sells for 3% coupon rate, then the yield is

If interest rates go up then the bond holder may need to sell their bond at a discount. If the investor sells the bond for $700 then the yield would increase. The yield on this bond would be:

In the above example we can see the bond yield has increased as the bond price has been decreased.

When are bonds popular?

Bonds are popular when investors are fearful and want to put their money in safe havens. Investors look at bonds as stable investments and products such as the US Treasuries are considered to be very safe investments. As demand and funds pour into bonds, this drives the prices of bonds up which is a positive for bond holders.

Lauren Hua is a private client adviser at Fairmont Equities.

Sign up to our newsletter. It comes out every week and its free!

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!