Markets in the US and Australia have recently seen some aggressive selling. The unemployment rate in the US hit a 17 year low of 4.1%, and this caused bond yields to spike higher. The combination of strong employment and bond markets anticipating an interest rate hike sent the market into a selling frenzy. These strong US employment numbers could mean high wage demands and rising inflation which unsettled equity investors. Rising wage pressure may hinder company profits due to increased expenses.

The stock market has experienced low interest rates for an extended period of time. This factor has caused the market to become overvalued relative to the fundamentals. The stock market has also rallied aggressively as corporate earnings have been positive. This may suggest that economic growth is back. Investors are now concerned the pace of rate increases in the US will be faster than expected. If economic and wages growth continue to rise strongly than the US Federal Reserve may increase the rate hikes. The US Federal Reserve has raised rates 3 times since Dec 2016 from 0.75% to 1.5%.

Why are rising bond yields panicking the equity markets?

We wrote about the relationships bonds and stocks in this article on the blog and why rising bond yields means higher interest rates. https://fairmontequities.com/relationship-bonds-interest-rates-stocks/. These are the three main reasons why high bond yields are a negative for stocks:

Higher Debt Costs

Rising bond yields are a negative to the stock market as many companies finance growth through debt. If interest rates increase then loan repayments increase which will hurt earnings. Rising interest rates are especially alarming for REITS and utilities as these companies use debt extensively and higher bond yields will hurt their valuations.

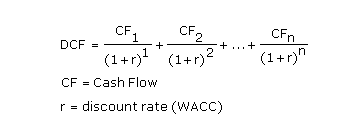

When an analyst evaluates a stock, they use the discounted cash flow method to assess whether the stock is an attractive buy. The analyst uses future free cash flow projections and discounts them to obtain a present value. To achieve this present value, they use 10-year bond yield to arrive to a present date value for that company. As bond yields rise, these discounted cash flows will rise and will make stock valuation look more expensive.

This is the complete formula:

In record low interest rates, we can see that REITS and utilities benefit with a rise in stock prices. However with bond yields rising, these REITS and utility stocks have plummeted in stock price as their valuation incorporating the higher bond yields has essentially made their valuation look expensive.

Lower Growth Expectation

Higher bond yields are a negative to the stock market as it may signal tighter monetary policy and lower growth expectations for companies. This may then lead to a stagnation or lowering of company profits which can mean depressed share prices and lower dividends.

Rotation out of equities

The increased yield in bonds will also make other asset classes more attractive in comparison to equities. Equity investments are riskier than bonds and investors seek higher returns to compensate this. The higher the bond yield, the more appealing bonds will look to the investor. Stock valuations start to look expensive when bond yields experience upside breakouts.

Lauren Hua is a private client adviser at Fairmont Equities.

Sign up to our newsletter. It comes out every week and its free! You can leave your email with us via the form on the right-hand side of this page.

Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!