Investors looking to fund their living expenses through their share portfolio typically select stocks which are high yielding to provide them with income. However, what we have identified over the years is that high yielding stocks have not perform well in the stock market and therefore have not created significant capital appreciation for their investors. The total portfolio returns are therefore worse for investors who hold income stocks. Companies which typically pay large dividends are usually blue-chip mature companies. As the growth phases of these companies are over, they do not need the cash to fund expansions or acquisitions and hence pay the funds in the form of dividends to investors. But what yield hungry investors are forgoing is the capital appreciation of growth stocks which over time can surpass the yield these income stocks promise to pay.

Let’s use some typical examples and analyse the total return between income and growth stocks. AGL energy (ASX:AGL) is a favourite for income seeking investors as it is a defensive utility with a historically had high dividend yield. However, the stock price performance has not been doing well for the last five years. As we can see, the share price has dropped 67% in this time.

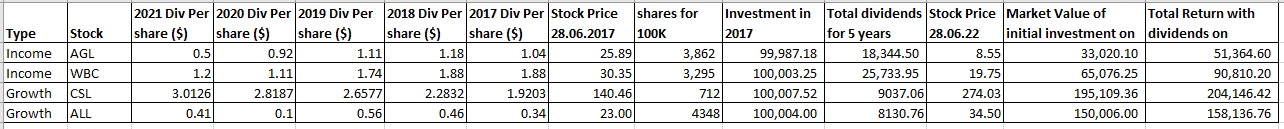

If we bought $100,000 worth of AGL (ASX:AGL), we would have been paid $18,344.50 of dividends over the last five years. However, the share price of AGL has fallen 67%. The initial capital of $100K would have eroded to only $33,020.310 as of 28/6/2022. The total return on the initial investment of $100,000 is only $51,364.60. This means that although investors have consistently been receiving dividends, they would have lost out in the drop in capital.

Another favourite for income investors are the banks. Westpac (ASX:WBC) has consistently been paying dividends over the years but the share price been declining in the last five years. If an investor purchased $100K of Westpac five years ago, they would have received $25,733.95 in dividends. However, the market value of their original investment of $100K would only be worth $65,076.25. The total return of the investment would be worth $90,810.20 which is still an overall loss of nearly $10K.

Growth stocks on the other hand have increased their dividends over the five years and the share price has also been appreciating. Hence income investors can benefit from growth stocks by the increase in dividend yield along with capital appreciation. If you are in it for the long-term, then this means that over time your dividends from the growth stocks can catch-up and surpass those being received by the income stocks.

If we use the example of CSL which is a growth stock, the company increased their dividend payout through the years. If we invested $100K of CSL back on 28/6/2017, we would have been paid $9,037.06 in dividends. However, our investment of $100K would have a market value of $195,109.36 as of 28/6/2022. This gives us a total return of $204,146.42.

Another growth stock which has performed well is Aristocrat (ALL:ASX). If we invested in Aristocrat (ALL:ASX) on the 28/06/2017 we would have made a return of 50% on the stock and received $8,130.76 in dividends over the five years.

Income investors looking at income stocks often forgo capital gains for higher yield. However, many don’t realise that over time growth stocks can increase their dividend yields and investors can receive capital gains on top of that as well.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!