Investors can use various fundamental ratios to evaluate the financial health of a company. One popular ratio they may use is return on capital employed. In this article we discuss what this is and why it is useful.

Definition

The return on capital employed ratio measures how the well company is using their capital to generate profits. A higher ratio indicates a high return on capital invested.

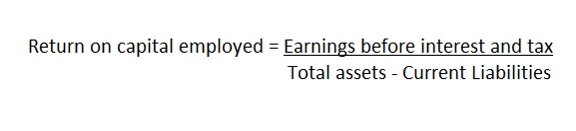

Formula to calculate return on capital employed (ROCE):

Why this ratio is useful?

This ratio can be used to evaluate companies in the same industry to compare companies and identify which is the most efficient in employing capital and turning it into profits. The ratio can also be used to be compared to the industry standard and the investor can determine how well the company is deploying its capital compared to its peers.

What’s the difference between return on equity and return on capital employed?

Although these two ratios seem very similar, the two ratios measure different aspects of the company. The return on equity ratio measures the net income the company generates in proportion to the shareholder’s equity.

ROE = Net income /Shareholders’ equity.

The ROCE formula measures how efficiently the company is using the capital in produce profits. High ROCE ratios indicate the company have a higher probability of profits.

Hence the ROE looks at the rate of profitability for shareholders where was the ROCE looks at the rate of profitability for the company. The ROCE ratio is especially popular when evaluating the sectors in oil and gas and utilities as these are capital intensive industry sectors and are companies with a lot of debt.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!