This post formed the basis of an article which then appeared in the Australian Financial Review on 6 September 2016. Michael Gable is a regular expert contributor to the AFR. You can access the AFR version HERE.

Resources, mining services, gold – they have all had a great run this year. Be careful to lump them into the same basket though. While I think gold has potential upside (see my previous post), I can see dangers signs in other parts of the commodities sector. The big Australian, BHP, is one stock which I think needs to be treated with some care here and you may be surprised at where the charts suggest it can fall to. I’ll explain what I am now seeing.

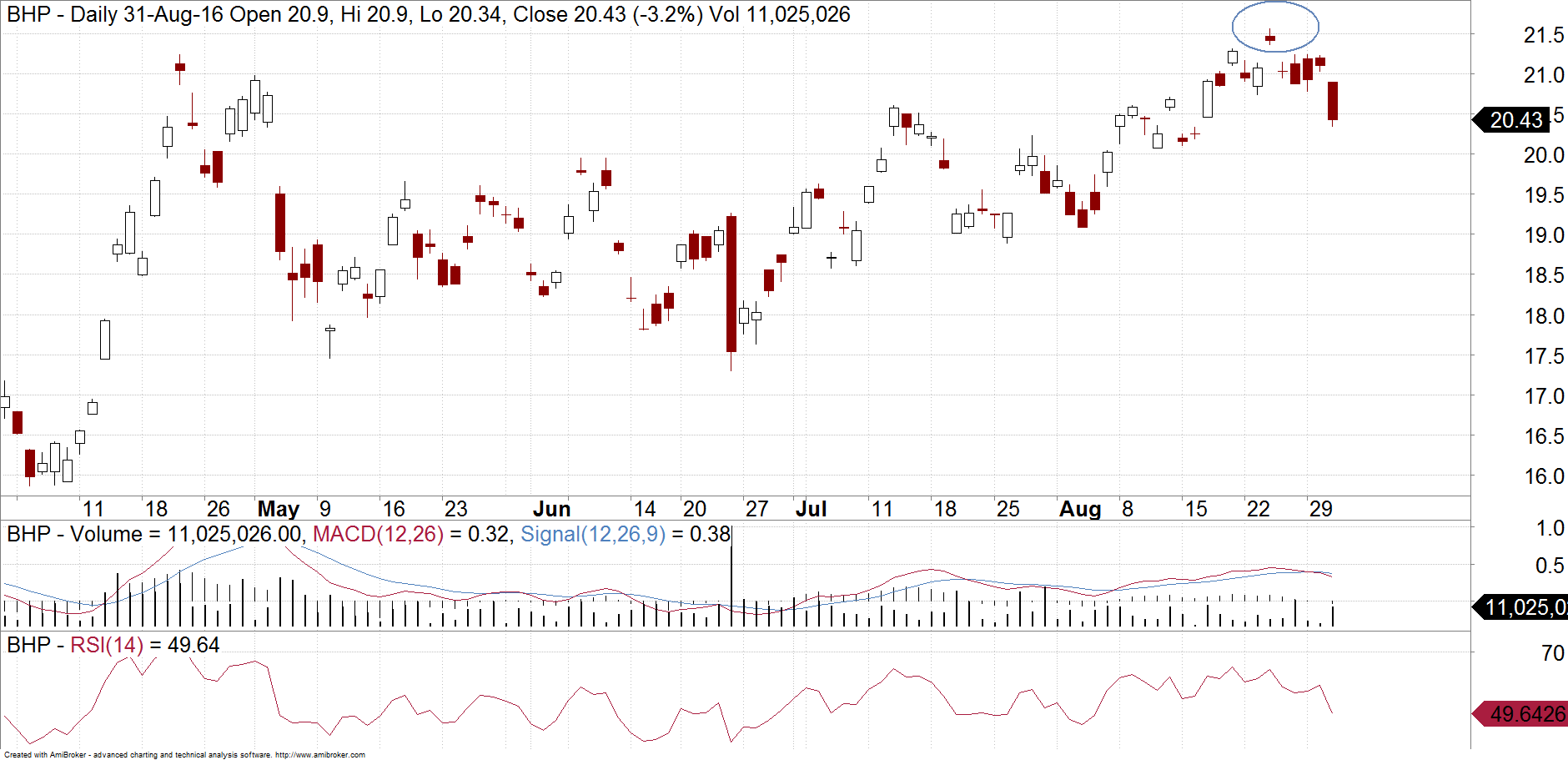

On 24 August, BHP gapped up and went to a new high for the year. It managed to surpass the high point achieved in April. However, the day after, on 25 August, it gapped back down and struggled for a few days. Since then it has been belted.

Ideally what we want to see on a chart, if we are bullish, is a stock consolidate under a previous high. It needs to let the market argue about where it should head next. If the sellers give up, then it has scope to go to a new high and sustain that move. However, it if just goes ahead and rushes to a new high, it leaves itself vulnerable to the sellers. This is what BHP has done. The sellers are now taking advantage of these levels and there is a lack of buying. This “island reversal” which I have circled on the chart is the sign of a top. By going to a marginally new high, BHP is now vulnerable to going to a marginally new low. That is, it will threaten the June intraday low of $17.29. At these levels, with the dividend now gone, traders may look to sell BHP or hedge their positions by writing some covered calls. Buyers would be advised to keep in mind those $17 levels before thinking about buying these dips.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free!

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.