With the end of financial year around the corner, it is worthwhile reviewing how your gains or losses are treated if you decide to sell your shares before 30 June.

Most investors are aware of what to do with gains on shares that were held for only a brief period of time, but investors who have held shares for many years should be aware of how the gains are taxed.

Any profits which you receive from the sale of your shares will be taxed as a CGT (capital gains tax) event. This means that if you have sold the shares for more than you bought them, they will be subjected to tax as the tax office will consider this as Capital Gains Tax event.

Company dividends will also be taxed as income but you will receive a credit on the tax the company has already paid. We have previously written up an article on the imputation credits on this blog. Please see this link. https://fairmontequities.com/an-easy-guide-to-franking-credits/

The biggest difference of how tax is treated with shares is how long you have held them and when you purchased them.

Please be advised that you should treat this information as a guide only and we recommend that you speak to a tax specialist as well.

Below are the different scenarios to be aware of:

- Owned Shares pre- 20 September 1985: You don’t need to pay tax

- Held shares for less than 12 months: No discount is allowed to reduce tax paid. Sale proceeds are subtracted from the purchase price.

- Held Shares for more than 12 months:

You can use two methods. The discount method and the indexation method. Choose the method which produces the least capital gain to minimise the tax you need to pay.

The Discount Method

You can reduce your capital gains by:

- 50% for individuals, partners in partnerships and trust

- 33 1/3% for Super Funds

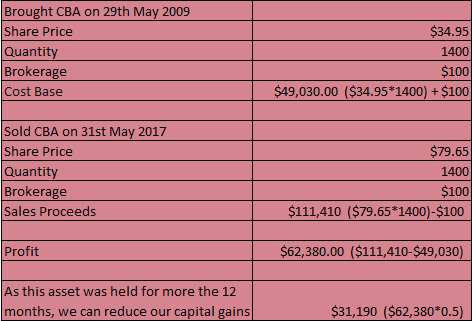

Please see below the calculation of the discount method of a sale of CBA shares which were held for more than 12 months. This tax payer will only need to declare $31,190 as her capital gain as opposed to her entire profit of $62,380 as she receives the 50% discount.

Example:

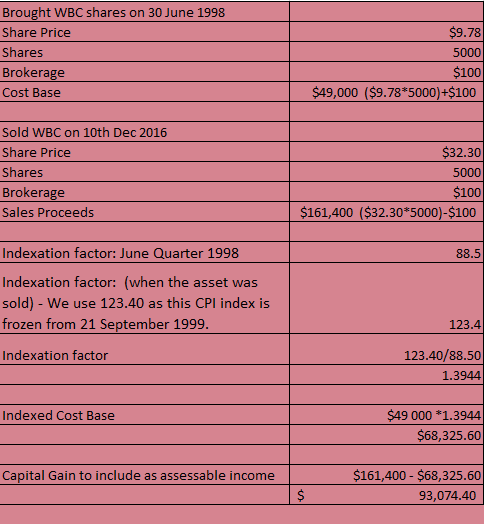

The Indexation Method:

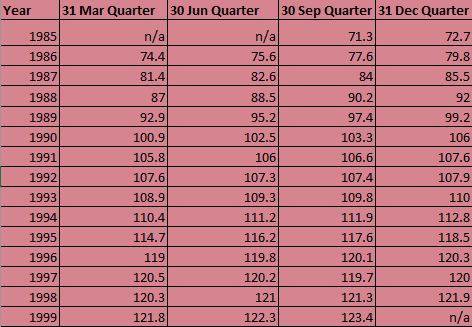

You can use this method if you have acquired assets on or after 20 September 1985 and before 21 September 1999 and you held the asset for more than 12 months. Use this method if it gives you a better outcome than the discount method. This method allows you to increase your cost base by applying the indexation factor which minimises your capital gain by reducing the tax payable.

![]()

CPI Table from 30 September 1985 – 30 September 1999

Indexation Example:

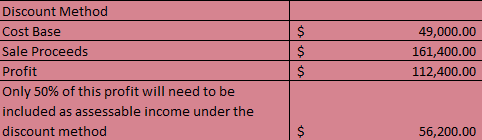

If we use the discount method the outcome would be better for the tax payer as the amount to be included as assessable income is lower.

Capital Losses:

Taxpayers can use capital losses on shares to offset capital gains in the same financial year. For example, if you made $100,000 from Company Yellow shares but then lost $40,000 from Company Red, you made a total profit of $60,000. If you held these shares for less than 12 months, then the entire $60,000 amount will be included as assessable income. Had you held these shares for more than 12 months, then the 50% discount will apply and you will only need to pay capital gains tax on $30,000.

If there are no capital losses in the relevant financial year these losses can be carried forward in later years to offset capital gains.

You cannot use capital losses on shares to offset your current taxable income.

Lauren Hua is a private client adviser at Fairmont Equities.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.