With the market near record highs, do we sell in May and go away? When we look at the evidence, perhaps its best to be a contrarian and do the opposite.

(The following is an extract from our client research report The Dynamic Investor, first published on Tuesday 7 May. If you want to be the first to know our thoughts, GO HERE and sign up to an 8-week FREE TRIAL.)

Do we sell in May?

We’ve had a volatile start to this week, and I’ve been asked by more than a few clients whether we should sell in May and go away. This is normal, as May typically brings with it the usual references to the Sell in May and Go Away or the so-called Halloween indicator. This oldie but not-so goodie originated in the US of course and suggests avoiding equities exposure over the American summer. The so-called Santa Clause rally and early new year inflows and push to get invested In January are assumed by many to push markets to post most of their upside between November and April.

While I am all for keeping things simple, we don’t all have the luxury of closing our investment portfolios and heading off to Florida like Jesse Livermore did each summer during the 1920s for some sports fishing and slower pace of life (which he rarely achieved – he couldn’t help but trade). On the contrary, most of us need to pay attention to our holdings and remain invested.

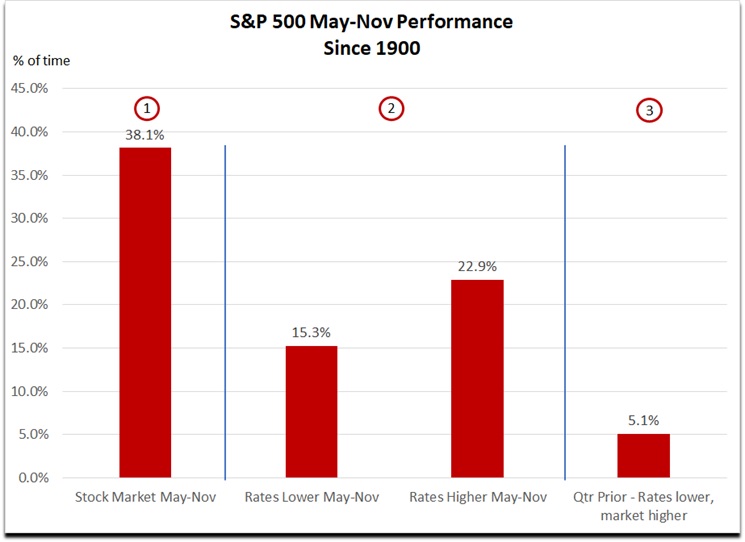

This is good news because as the below chart shows, the old “sell in May and go away” investment strategy leaves a lot to be desired. I have broken this chart into three sections as follows:

1. Percentage of stock market declines May-Nov each year since 1900 (118 years).

2. Percentage of stock market declines May-Nov under different 10yr bond yield scenarios – up and down.

3. Percentage of stock market declines when stocks were higher during the prior quarter, but yields were lower – such as 2019.

What does the evidence tell us?

With the US stock market declining May through November only 38% of the time, you are not being paid very well to close-up shop and head to Florida with Jesse and his extensive group of hangers on. Of that 38.1% of the time the market was down 15.3% with lower bond yields, and down 22.9% of the time with higher bond yields. What I think is more telling is how 2019 stacks up with the past as we head through May. The first four months of 2019 have been a solid start for US equities (not so much Aussie equities), so it makes sense to compare this year with past instances where the market had a good start, with yields declining as they have year-to-date, but then fell away through to November. This has occurred only 5.1% of the time – hardly good odds. Heck, with odds this low, I wouldn’t even be desperate enough to try hocking the mother-in-law. It just would be worth the aggravation.

What would be worth the aggravation is having a plan. Given the myriad of potential geopolitical, economic, and technical influences we can expect to impact the stock market over the remainder of 2019, my strong suggestion remains a two-pronged approach that consists of: 1) To be holding a group of solid, high-quality companies as a core portfolio and 2) Being nimble with peripheral opportunistic trades. In this way, investors have exposure to the compounding rate of growth of the stock market over time and can participate in the faster moving stocks on a short time frame.

Being consistently protective of capital is one of the most concrete investment foundations that all stock traders could aim to achieve and utilise. It isn’t necessarily always easy to focus on maintaining capital efficiency and jettison poorly performing positions, but it’s necessary. The other most concrete foundation for investment success is allowing good positions in stocks that are working to continue working and not cutting the position prematurely. In fact, apart from cutting losses short, letting good positions run is vital for investment success.

The best method I have utilised to achieve this and remove the human weakness of emotion (when trading is concerned) is the trailing stop. We have spoken to many of you about this and some clients are using trailing stops. Others might prefer to hold stocks and find losses difficult to crystallise. As I said earlier, it isn’t easy. Yet I remain certain that utilising trailing stops is the most effective way to exit a stock market position as it removes our own weaknesses and allows us to let the market tell us what to do.

Managing the situation

In pulling this week’s comment together, I’ll finish with a little story. In 2006 I was managing the Asian equity portfolio at a hedge fund in Sydney. I was investing across Asia, including Japan and things were starting to look a little too happy for my liking. No, I am not a human depressant, but the equity market had reached a level of buoyancy that I thought was unjustified on fundamental grounds and I was concerned about the potential for a correction. Asian equity markets can move very quickly, and you need to be quick when things turn ugly. To cut a long story short, I pulled everything out. Several months later after the decline had run its course, a major investor from Germany was in town and over lunch asked me “how did you know the market was about to go down?”. I replied “I didn’t. I let the market tell me what to do. My trailing stops did the work for me”. He simply nodded, continued wiping his prawns through his sauce, and returned to Germany reassured.

Markets will always give us reason to pause, think, and endeavour to make the right decisions to protect our capital. Protecting capital in a disciplined manner ensures your long-term survival as an investor and can be significantly rewarding in terms of enhancing performance. Many academic studies have shown the consistent and disciplined use of trailing stops as being significantly performance enhancing.

So as this week continues, we look ahead in 2019, and march onwards through to year end our most important investment strategy can be summarised with a simple sentence:

Listen to the market.

Gordon Anderson is Portfolio Manager at Fairmont Equities.

Current share prices available here.

You can learn more about technical analysis in this article.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!