Start of the three week of a new calendar year (On that note Happy New Year to all) and already the word of 2017 and has been released by Macquarie Dictionary – I think I have already spotted what the word of 2018 will be: ‘Goldilocks’.

The two major economic think tanks in the IMF and the World Bank finally crunched enough numbers to agree with what the rest of the economic world has been saying for 12 months – 2018 is likely to be the best growth year for the Developed World since the GFC and global growth is likely to increase by its largest rate since the GFC. The current consensus for global GDP is approximately 3.6%, inflation “should” to begin to materialise meaning risk assets (Growth) will benefit – which I’m pretty sure they have been already.

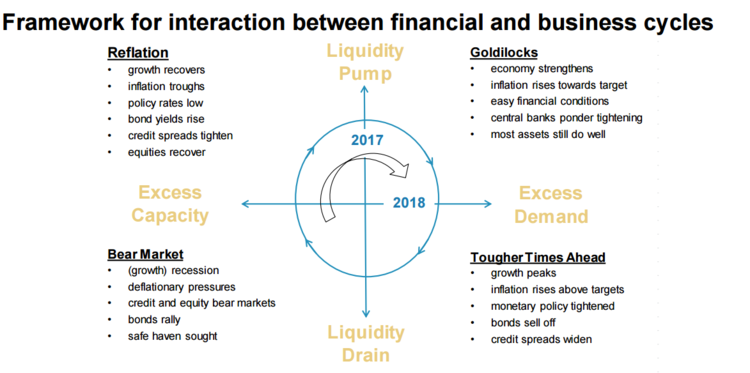

Morgan Stanley here perfectly describes the globe’ Goldilocks period the world is in. It also shows how far off the bears are. The question is ‘time’ – when does the liquidity drain begin?

The ‘pondering tightening’ point is certainly taking shape of the central bank releases in the past 6 weeks agree most minutes show they are dithering – The ECB being the latest with its released of the minutes from its December meeting which stated that it would consider moving its three target rates on the caveat that communication and certain market events would need to occur before it was willing to bring its scenario to fruition. The Fed too is forecasting rate rises 2018 however the speed at which is can enact these increases remains a topic of debate and with Jerome Powell basically 2 weeks away from taking up the post one will expect new communications and points of interpretations – Goldilocks is sleeping soundly and unlikely to be disturbed for the near future.

That begs the question – where does Australia fit into this scenario? Growth has been ahead of expectations of late – net export and private investment begun to pick up the slack in 2017 and are likely to continue this trend in 2018 – the concern is consumption. Inflation however is a long way off where it is needed to be and being the core mandate of the RBA – Australia’s monetary policy will be unchanged for a record 18 months and counting (In my view for at least the next 9 months probably more).

The jigsaw that is Australian inflation has an import read on Thursday with the release of the December employment numbers. 2017 will be the best year for employment since 2005 consensus expectations for the December print is 18,600 jobs added a perfect end to a close to perfect year – so far, the 12 months to November 2017 Australia has added just over 375,000 jobs with the unemployment rate hitting 5.4% last year. The jigsaw part has been that employment growth hasn’t translated in to wage growth.

The emphasis the RBA now places on wages is clear as the feed through to inflation and consumption is strong. The fact that over 58% of the average week wage goes to ‘basics’ (the five standard living essentials) means meaningful inflation and consumption are likely to crimped with wages still stagnate – further evidence Australian monetary policy will be on the fence for the foreseeable future.

Back to growth – China releases its final 2017 GDP read on Thursday – the Q4 figure is likely to be a foregone conclusion with Premier Li Keqiang last week stating that 2017 GDP was likely to grow at ‘around 6.9%’. What was more interesting from his comments was the belief that 2018 is likely to reflect 2017 which s ahead of the consensus expectation of 6.7%. This would suggest that the China ‘hard landing’ story appears to be a further few years off.

If 2018 is a ‘global growth world’ China is one of the best markets to absorb the returns from this scenario an, by translation, Australia too will benefit as demand for raw goods increases to meet the needs of the growth story. This suggests materials are likely to outperform once again in 2018 as they did in 2017.

Goldilocks is here – the bears are no-where to be seen (yet)

Evan Lucas is an expert guest contributor to Fairmont Equities.

Evan is founder of The Lucas Review. Prior to that he was Market Strategist at IG. He is well known as an expert commentator in finance media such as Sky News Business, ABC1, the Australian Financial Review, CNBC, and Reuters.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!