At Fairmont Equities, we conduct dozens of free portfolio reviews every year for investors looking to improve their returns. There are a range of reasons as to why a portfolio does not live up to an investor’s expectations. One of the common problems we see over again is an over reliance on shares with a high yield. Often an investor chooses high yielding stocks because they are investing via an SMSF, even though they are still in accumulation phase. They feel as though SMSF’s need to be generating income when in fact they are not living off the income yet.

Investors who do need to fund their living expenses through their share portfolio of course typically select stocks which are high yielding to provide them with income. However, what we have identified over the years is that high yielding stocks have not perform well in the stock market. Over time, these companies have not created enough capital appreciation for investors to maintain their capital. Companies which typically pay large dividends are usually blue-chip mature companies. As the growth phases of these companies are over, they do not need the cash to fund expansions or acquisitions, and hence pay the funds in the form of dividends to investors. But what yield hungry investors are forgoing is the capital appreciation of growth stocks which can surpass the yield these income stocks promise to pay.

By not paying attention to the capital value of your investments, it leaves you more vulnerable to a market downturn. There is also the risk that in tough times, these companies will cut their dividends anyway. Investors can do better by focusing on their “total shareholder return” and withdraw their “income” from a higher valued “growth” portfolio. Remember, “growth” doesn’t mean higher risk.

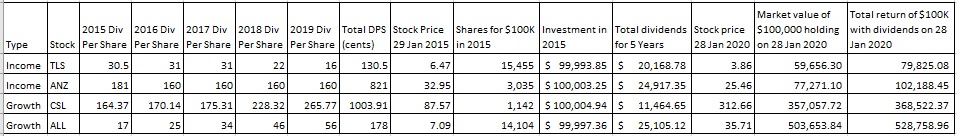

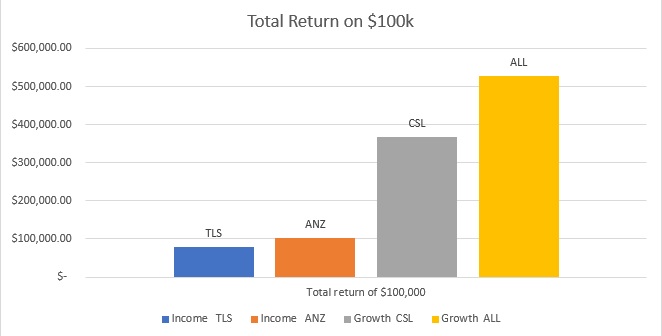

Let’s use some examples and analyse the total return between income and growth stocks. Telstra is a favourite of income seeking investors. The dividend yield on this stock has typically been high but stock performance of this has been struggling for the past few years. If we brought $100,000 worth of Telstra (TLS:ASX) 5 years ago, we would have been paid $25,621.92 of dividends during that time. The dividend yield has also been decreasing over the years because Telstra is not a growth company. Also during this time, the share price of Telstra has almost halved and the capital of $100K would have eroded to only $59,656.30 as of 28/1/2020. This means that the total return on the initial investment is $79,825.08. This demonstrates that investing for income would have actually cost you about $20k.

Another favourite for income investors are the banks. ANZ decreased their dividend once in 2016 but has since been consistently been paying out a yield of 160c dividend per share each year giving the investor a dividend income of $24,917.35 over the course of 5 years from a $100K investment. The share price has however decreased from $32.95 (29/1/2015) to $25.46 (28/1/2020) so the initial investment of $100K would be worth only $77,271.10. Adding the dividend gives you a total return of $102,188.45.

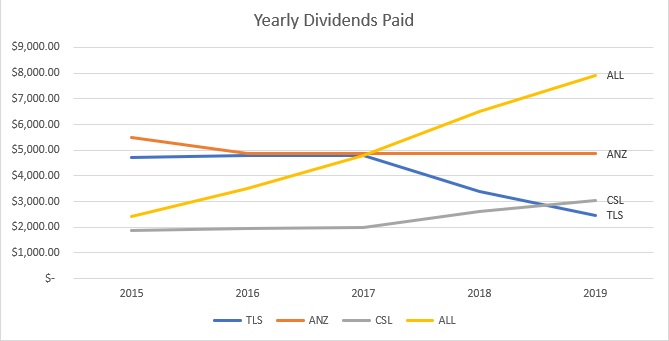

While income stocks have decreased their dividend payout or kept them constant, growth stocks have increased their dividend over the five years and the share price has also been appreciating. Hence income investors can benefit from growth stocks by their increase in dividend yield along with capital appreciation. Lets use the example of CSL which is a growth stock (remember, “growth” doesn’t mean high risk, with CSL being a classic example). The company increased their dividend payout of 164.37 cents DPS (dividend per share) to 265.77 cents (DPS) by 2019. If we invested $100K of CSL back on 28/1/2015, we would have been paid $11,464.65 in dividends but our investment of $100K would have had market value of $357,057.72. As of 28/1/2020 we are left with a total capital return of $368,522.37.

Another growth stock which has performed phenomenally is Aristocrat (ALL:ASX). This company has increased their dividend of 17 cents DPS (dividend per share) per year to 56 cents DPS per year as of 2019. If we invested in Aristocrat (ALL:ASX) on the 29/1/2015 we would have made a return of 404% on the stock and received $25,105.12 in dividends over the five years. Yes, you read that correctly. Aristocrat’s dividends over 5 years in dollar terms is actually greater than ANZ’s, and only a few dollars less than Telstra’s. So it starts low in year 1, but by year 5, it has caught up in dividend terms. And you then have a huge capital balance to draw from compared to the income investor. When you look at the table below, you can see that Aristocrat is paying a greater dividend each year than ANZ and Telstra combined. And it is still growing. Even an investment in CSL 5 years ago would see you receiving more per year in dividends than your Telstra investment.

Income investors looking at income stocks are forgoing capital gains for a higher yield today. However, over time growth stocks can increase their dividend yields and will catch up. Not only that but investors can receive crucial capital gains on top of it too. By planning ahead, and making the chances to your portfolio sooner rather than later, you have the potential to set yourself up for better dividends in the future. If you are in a position to do so, early pain can mean a long term gain in retirement.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!