This post formed the basis of an article that appeared in the March edition of the ASX Investor Update on 14 March 2017. Michael Gable is a regular expert contributor to the ASX. You can access the ASX version of the article HERE.

After steadily rising for a number of years, health care stocks have entered a period of volatility and uncertainty. Two years ago I analysed the prospect for healthcare stocks and at the time the S&P/ASX 200 Health Care sector index was pushing past 18,000. I was expecting some of the larger stocks to continue higher. Last year the index briefly touched 23,000 before easing back. However the steady uptrend in some of the large health care stocks, and the index itself is now starting to look under threat. We are seeing some deep pullbacks now and some of the reasons are related to events in the US. It is well known that US President Donald Trump plans to repeal the Affordable Care Act which has an effect on the number of Americans obtaining health insurance. He also plans to increase competition in the health care space in order to drive down drug prices. These changes could have a negative effect on health care stocks and this uncertainty has stopped the uptrend in its tracks. The other point now weighting on the sector is the valuation. For the last few years, we were living in a low growth world. Investors rushed into companies with reliable earnings growth due to an absence of opportunities elsewhere. In Australia this meant that certain stocks, including some of our major health care stocks, became more and more expensive. Despite the recent falls, a stock like CSL still trades on a forward multiple of 27 when the S&P 500 Biotech sector in the US trades at about 15 times next year’s earnings. With an expectation that Trump is going to spend big in the US, and bond yields starting to rise, it is the cyclical stocks in the market that are now getting a look in. Stocks that have been inflated to large multiples are coming under pressure, including our reliable health care stocks.

Alongside this backdrop, it is worth revisiting the charts of some popular health care stocks. I will look at CSL, Ramsay Health Care, Healthscope, and Sonic Healthcare.

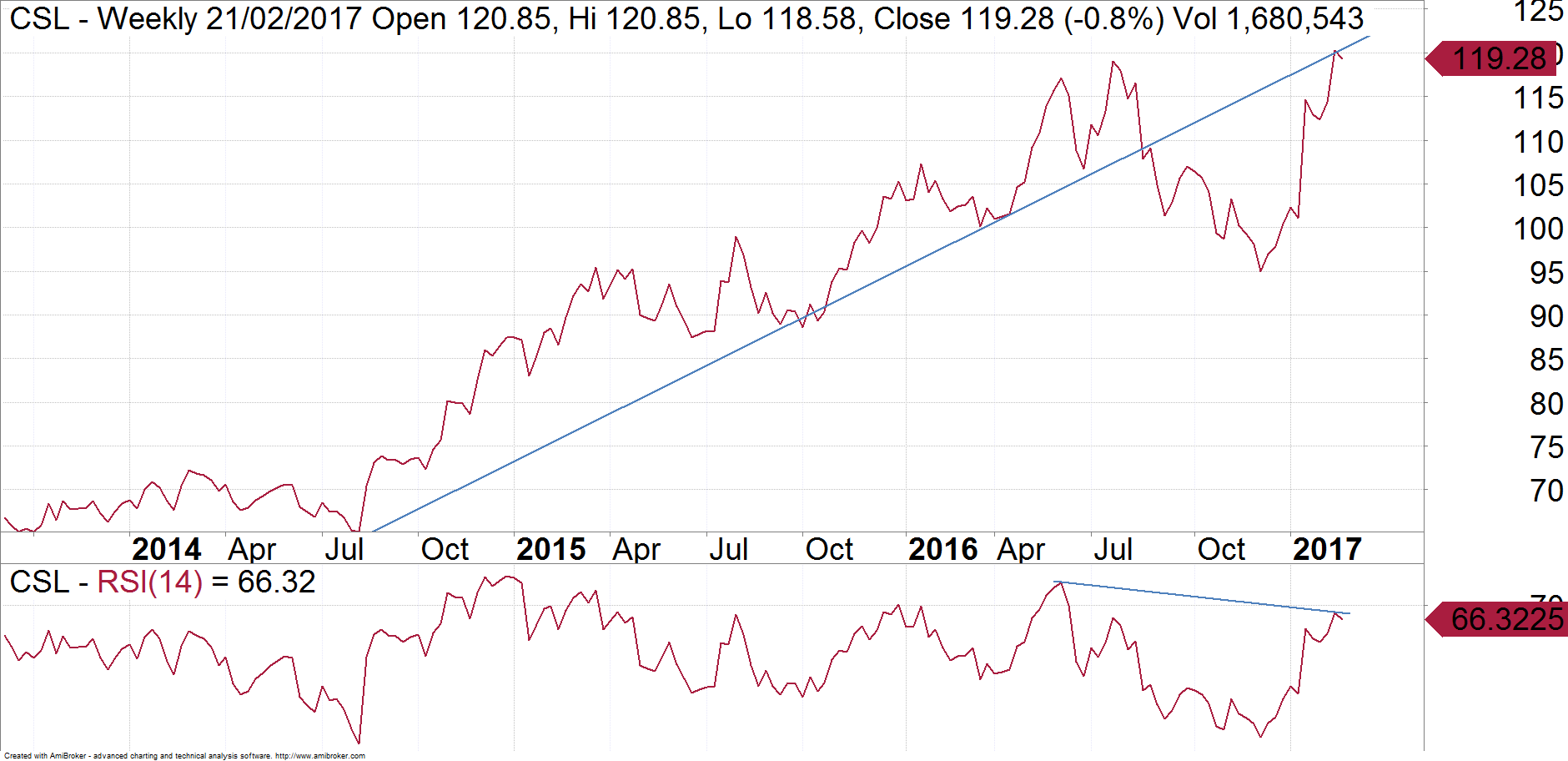

CSL

CSL has seen an almost 4 fold increase in its share price during the last 5 years. What many investors forget though is that the share price did nothing in the few years prior to that. So CSL can endure periods where there is a lack of buying interest. Despite the fact that the business is still growing well, we may enter another period where the market doesn’t want to pay up for it anymore. Growth can now be found elsewhere for much cheaper prices. Last year we saw CSL drop over 20 per cent to dip under $100 per share. It has since rebounded very strongly but that dip last year saw it break the uptrend. The recent rally to a new high is unlikely to be sustained as investors need more time to now consolidate the large gains from prior years. I can also see that the Relative Strength Index (RSI) has made a “lower high” as the stock price has briefly made a “higher high”. This divergence is also a signal that we may see some weakness. At best, I believe that CSL will take a pause here and spend much of the year going sideways in a large trading range.

Ramsay Health Care

Ramsay spent much of 2015 taking a breather from its uptrend before rallying to a new high at over $80 last year. Ramsay then dropped to levels under $70. It is finding some support at current levels but the lack of a strong rally from here makes me think that it could be in a 4th wave. In Elliott Wave analysis, a stock can move in 5 waves. So by only being in the 4th wave, it implies that there will be another move down. The key point to look for is whether the stock overlaps its 1st wave which ended near $76. Essentially this means that if Ramsay starts to trade above $76, then it should go on higher, but if it fails to go through $76, then it will be in real trouble and we should expect it to head back towards the low $60’s. If that were to occur, then I doubt it would resume the long term uptrend. Like CSL, it may spend much of this year trading sideways in a large range between about $60 and $80. This is great for traders who keenly watch the market, but not so good for the “buy and hold” investor.

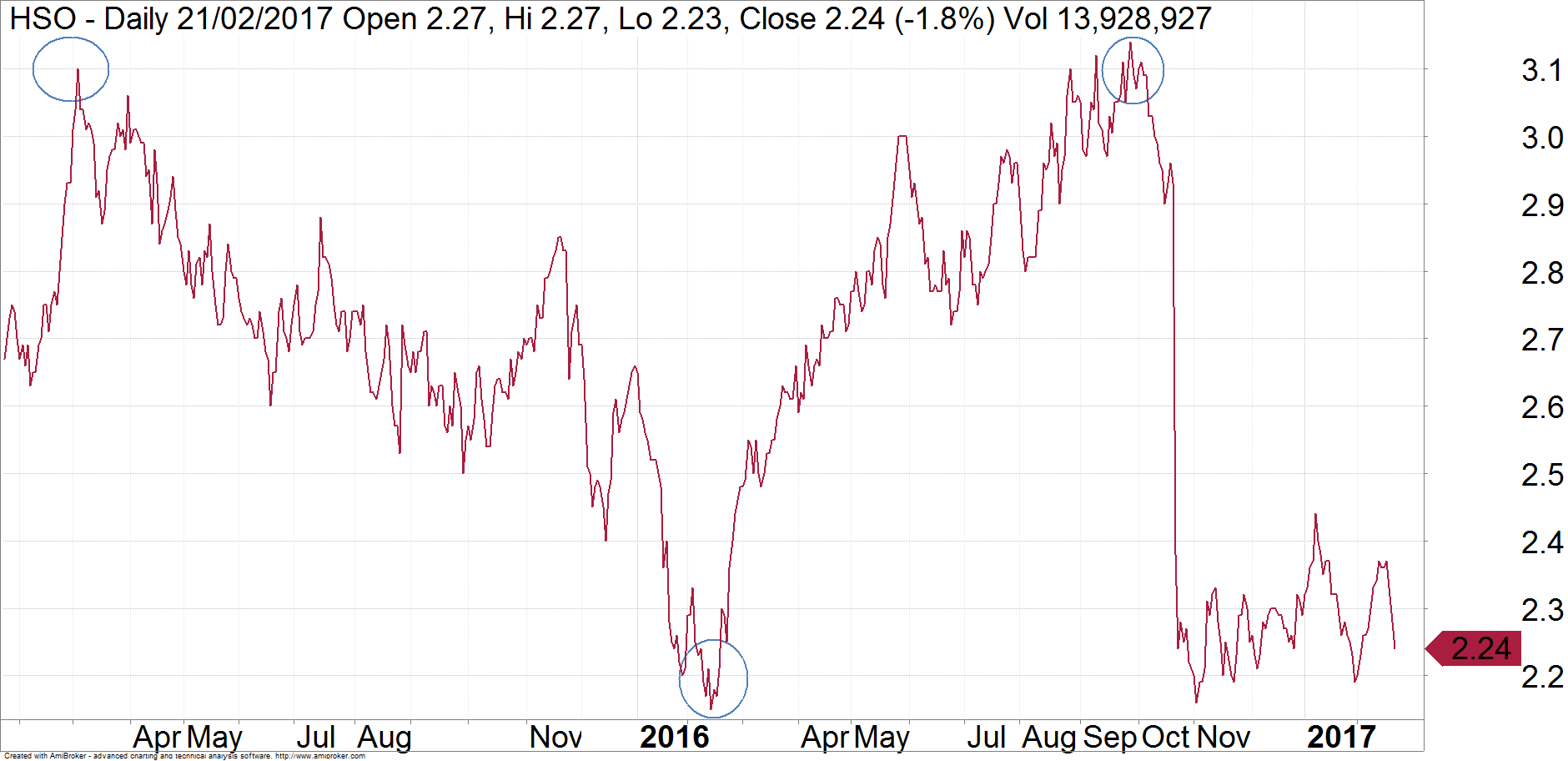

Healthscope

The private hospital operator took a tumble last year, not long after seeing it make an all time high of $3.14. Within a few weeks of that, the share price had shed nearly a dollar. Since that point in November, the shares have been drifting sideways in a range between about $2.20 and $2.40. It may well build a base here and start to trend higher, but at the moment we are not seeing that happen. One likely scenario is that Healthscope makes a brief return to about $2.10. This is the reason why – when Healthscope made a high last year, it was only marginally above its previous high back in 2015. It only lasted a few days before getting sold off. When you see a stock make a brief new high but it gets sold off, then it will often make a brief new low. That is, if the previous low point was in early 2016, then it is likely to briefly dip under that. And that would imply a visit to the $2.10 zone. Unless I see an uptrend get established, I am happy to sit on the sidelines in anticipation of those cheaper levels.

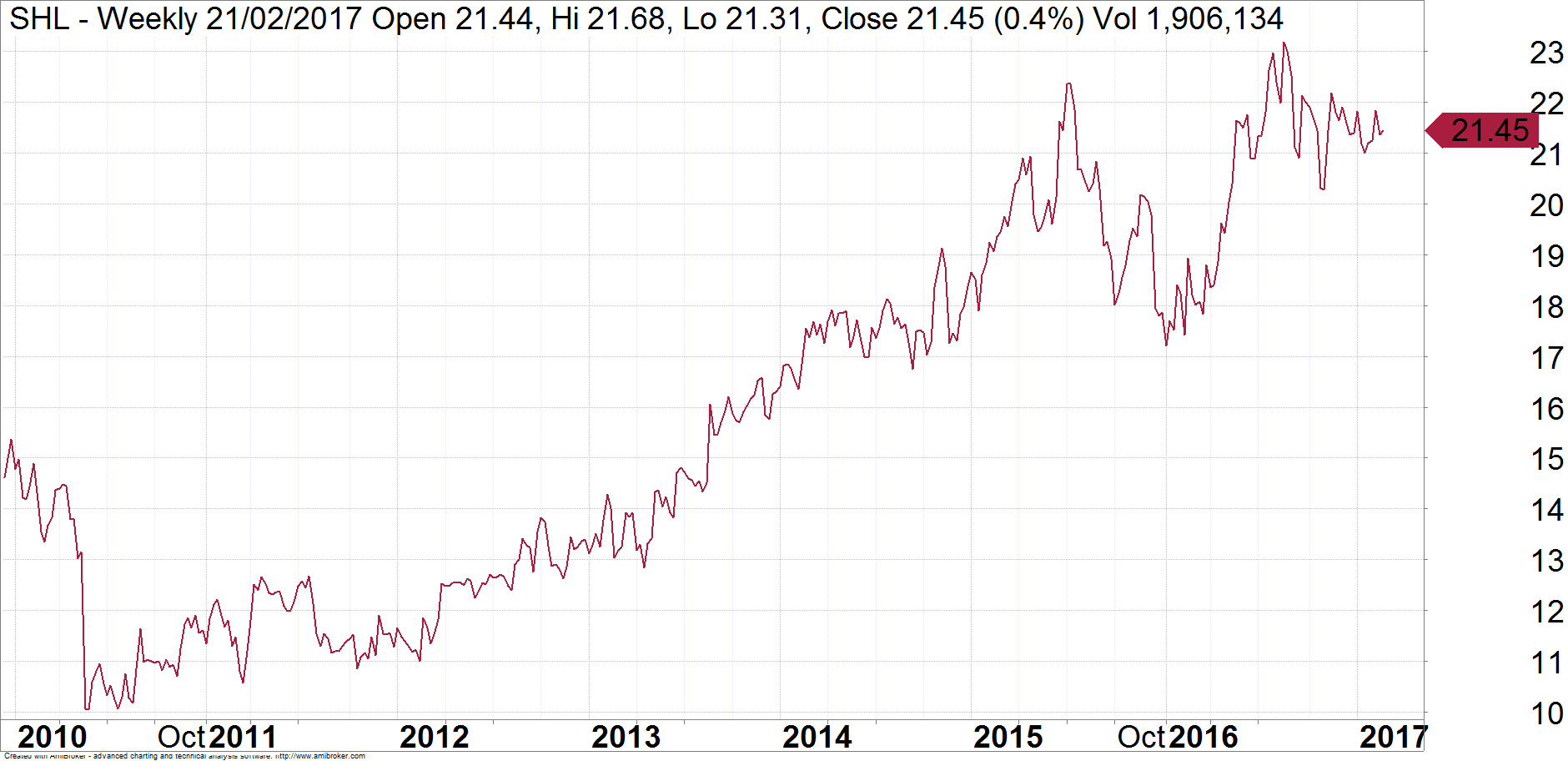

Sonic Healthcare

The chart for Sonic Healthcare is similar to that of CSL in my opinion – but it is a little more advanced. It was sold off at the end of 2015, breaking the uptrend in the process. It has since rallied back to a slightly new high but it was unable to continue on. The last 6 months has seen Sonic Healthcare ease back and I expect it to come all the way back to last year’s low near $17. So like CSL, the share price is likely to go sideways in a large trading range in order to consolidate the large rally that occurred from 2010 to 2015.

The environment for health care stocks has become a little more uncertain recently and the charts support the view that price action for stocks will be choppy at best. It means that “buy and hold” investors shouldn’t expect too much from health care stocks in 2017, but those who are little more active can make money in trading the range. So this means that for many stocks like CSL, we have trimmed them back up here with a view to buy a dip after the next correction.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email Michael Gable directly at michael@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.