Franked dividends are dividends which have a tax credit. The company has already paid tax so when it pays the shareholder a dividend, a tax credit is given to the shareholder. Franked and unfranked dividends can make a significant difference on the after-tax income the shareholder receives.

Why were franked dividends introduced?

Franked dividends were introduced in Australia in 1987 to avoid double taxation. Companies were already paying a corporate tax rate of 30% on their earnings and distributing their earnings in a form of dividends to shareholders. The imputation system was introduced to prevent the shareholder from paying tax on these dividends again.

How to calculate tax with franked dividends

Let’s use an example:

Fortescue has 100% franked dividend

They pay $2.11 for each share held

Shareholder has 1000 shares of FMG

Cash Dividend = 1000 shares*$2.11 = $2,110

Company tax rate is 30%

To work out the franking credit = Dividend Amount * Company Tax Rate/(100% – Company Tax Rate)

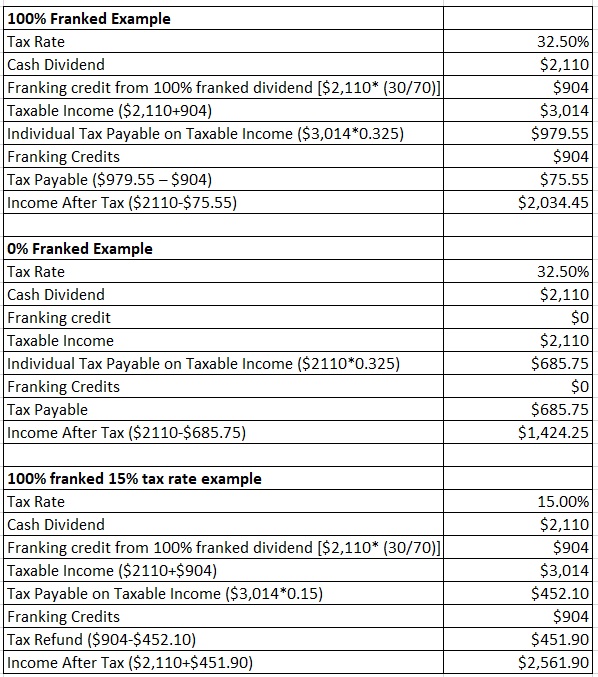

By comparing the examples, the 100% franked example receives more income as the franking credits reduces the amount the shareholder pays in tax. The shareholder with 100% franked dividend receives $2,034 income after tax versus $1,424.25 (what the shareholder with the unfranked dividend has received). In the example of the tax payer with 15% tax rate, they receive the tax refund as they only need to pay $452.10 in tax and the franking credit gave them a tax offset of $904 (which is more than what was need to be paid) so they receive a refund of $451.90. The shareholder receives the refund and the dividend in the end ($451.90+$2,110).

Why do companies pay partially franked dividends or unfranked dividends?

Companies may only pay out unfranked dividends if they do not pay company tax in Australia as they are domiciled overseas. If a dividend is partially franked, the company has only paid a partial amount of tax on their profits before distributing to shareholders.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!