A stock market plunge can leave investors very nervous and create panic. However the odds are that stocks prices will be higher in three to five years after a bear market. Bull markets follow bear markets so investors who panicked and sold at the bottom of the market lost out on the gains when the market recovered. But overall if you look at the stock market on a long term view you will find that there are more years where the market return was positive compared to the years when the market return was negative.

Black Monday 19th October 1987

The stock market crashed on this day and the Dow Jones plunged 23%. It was the largest one-day percentage point drop ever. If you were an investor and had $10,000 invested before the cash, you would have been left with $7,700 however your investment would have surpassed $10,000 by October 20th of 1998.

Dot com bubble 2000-2002

The Nasdaq peaked at 5048.62 points on March 10 2000 before crashing to 1114 points on October 9 2002 which is 78% down from its peak. However if an investor invested $1000 in the S&P 500 before the crash and continued to add $1000 each year then it would take the investor 5 years to recoup their losses from the dotcom bubble.

Great recession 2007-2009

On 29th Sep 2008, the Dow Jones fell 777.68 points in one day when Congress rejected the bank bailout bill. On October 9 2007, the Dow hit its pre-recession high at 16,164.43 but by March 5, 2009, it had dropped more than 50 percent to 6,594.44. The 2008 crash took 18 months to unfold but it took 2 years to recover. By 24th July 2009, the Dow Jones had reached a higher high (post recession) level of 9,093.24 and many considered the crash of 2008 to be over.

5 Feb 2018: The Dow Jones dropped 1,600 point in one day and was the biggest one day point drop in history. However the index closed at 24,345.75 which is a drop of -4.6% from previous days trading which is not the largest percentage fall. The previous day’s close before the fall was 25,520.96 but by 26th Feb 2018 the Dow Jones had already recovered these losses by closing at 25,709.27.

Stock market long-term returns

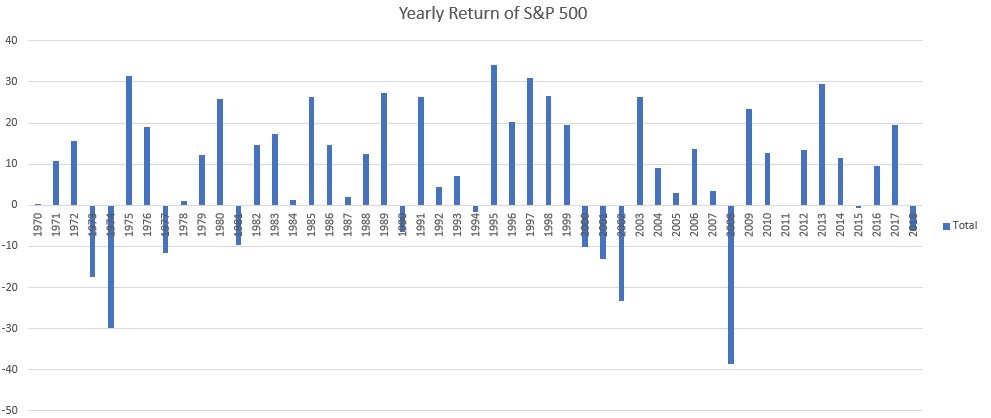

If we look at the S&P500 on a long-term basis and track the yearly returns from 31/12/1928 we find that only 29 years were negative (the index closed lower than the year before) and 61 years were positive. This shows that the stock market overall returns more years with positive returns than negative. This also demonstrates that if the market does have a crash or pull back, it does eventually recover and heads up even higher.

The below chart shows the yearly returns on the S&P500 for the last 30 years beginning from 1970. Only 12 years have delivered negative returns and 37 years delivered positive returns.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!