The definition of a share buy back is when the company repurchases their own shares in the open market. Once shares are sold back to the company, the total number of shares the company has on issue is reduced. This means that a larger portion of shares is held by the company compared to before the buy back. Companies do this as a way to return wealth to the shareholders.

Reasons for companies participating in share buy backs

- Management might see the share price as undervalued and buying shares back will increase the value of the remaining shares. A company may choose to do this if they expect their share price to rise in the future.

- Share buy backs also reduce the number of shares in the open market and can help prevent the chances of hostile takeover by increasing ownership.

- Reducing the shares on the issue can have a positive impact on financial ratios. These are important as investors use these ratios when selecting stocks.

Some of the ratios a buyback can affect are:

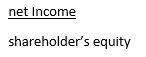

1.Return on Equity (ROE): This is how much profit the company can earn from your money. The formula for this is:

If the company’s earnings is the same but the share holders’ equity is reduced then it results in a higher ROE.

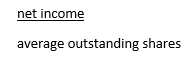

2.Earnings per share (EPS): The formula for this ratio is:

A high ratio would reflect a company’s strong ability to produce a solid return.Hence a reduction in average outstanding shares would increase the value of this ratio.

Consequences of buy back

In the short-term share buy backs can help the stock increase in value as it reduces the number of shares on issue. It also generates investor interest and hence buying activity. This is because buy backs show management have confidence in their company. Companies which can execute a buy back show they are in a strong cash position. Mature companies are more likely to be able to facilitate buy backs as growing companies are likely to be concentrating on paying off debt.

In the long term there are other factors affecting the stock price.

Share buy backs are generally a positive for a company but the overall financial situation of the company is needed to evaluate this.

Tax Implication of buy backs

With a share buyback, there are two components

- A dividend component and

- A capital component

The split of these two is decided by the company. They need to ensure the portion is such that split is not too low in capital component. This is because it will inflate capital losses. The other problem is if the capital component is too high, which can inflate capital benefits.

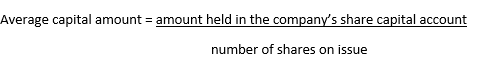

The ATO prefers the “Average Capital Per Share” as the method for calculating the capital component for buy-backs.

The formula for this is:

Once the capital component is calculated, the remaining amount would be the dividend component which could be franked.

A recent example of a buy back is RIO.

On the 13 Nov 2017 Rio completed an off-market buy back where the buyback price was $63.67 per share which was a 14 per cent discount to the market price. The capital component was $9.44 and the rest of the amount $54.23 was the dividend component.

Depending on whether you held these shares in a SMSF or individual tax payer and the price you brought the trade at, share buy backs can put you in a better after-tax position than selling the shares on market. The reason for this is due to the inclusion of the reduced capital component and franked dividend in the tax calculation.

Lauren Hua is a private client adviser at Fairmont Equities.

Sign up to our newsletter. It comes out every week and its free! You can leave your email with us via the form on the right-hand side of this page.

Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!