The Macro stuff:

Can’t escape what happened in the AUD over the weekend – despite a weak USD to finish last week’s trading week – AUD lost ground, and from where I am sitting it’s all to do with the Statement of Monetary Policy (SoMP).

The suggestion from the release is pretty clear – RBA will be unable to reach its longer-term objectives inside the next 26 months and the conclusion – clouded outlook, an AUD that is clearly above the RBA’s comfort level and domestic growth is likely to wane.

Keys to the read:

Inflation

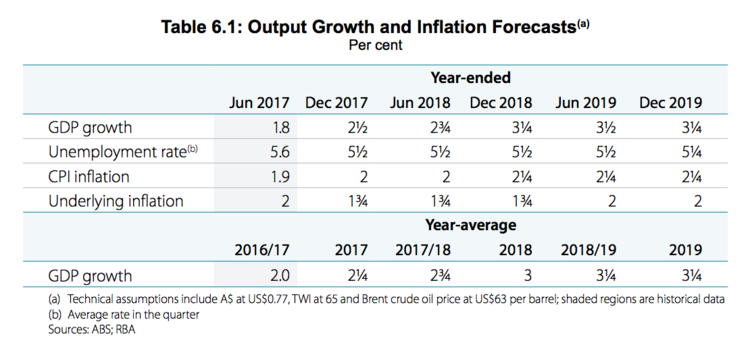

A 50bps downgrade to core inflation to the forecasted period is heavy – this means at no point in the next 2 years will core inflation breach the inflation band of 2% to 3%. Realistically if the RBA was to consider raising rates core inflation needs to 2.5% – which it isn’t and won’t be!

- RBA believes there is a 0.3% overpricing in inflation – therefore current core inflation is 1.5% not 1.8%

- Expects an impact in retail spending due to international raiders hitting the market over the coming 24 months – Amazon

- Wage growth expected to take longer than previously forecast citing international experiences (i.e. US and Europe and its policy stances to increase wages over the past 8 years)

The question now is will the RBA change its mandated level to reflect the current environment and to become more inline with developed nation peers? (i.e. scrap the band and look to a 2% consistent level?)

Even the bright spots had slight negative connotations here are the key points from;

Domestic Investment

- Mining investment revised up due to overruns in several LNG projects

- Notes that housing investment has peaked – cited apartment approvals and the slowdown in markets such as Sydney

- Iron ore shipments expected to be modestly higher – to wane over the forward years.

- Non-mining investment was raised a notch reflecting the figures seen in the capital expenditure releases in September.

The final part of the SoMP that really matter was;

Employment

The labour market has been a real bright spot – Australia is on track for its best year of job creation since 2005 aloud upgrades here

- Unemployment rate is likely to fall to 5.25% by the end of 2019 a 25bp decline

- Expects spare capacity to fall out by 2019 as hours works picks up as does participation.

- The negative – no adjustment was made to the wage prices index due to below average productivity growth and feed through from the conclusions from inflation.

In short, the SoMP has one conclusion: RBA is out of the market – rates are on hold now for at least 12 months one could argue 24 months.

AUD reaction – despite a fast recovery on the release of the SoMP on Friday once Europe and the US hit the floors, the structural changes to the outlook for Australia caused basically one directional trading – down, down and.. – Question is will it stay down?

A lower AUD from an equity perspective is some that is need in 2018 – cyclical and growth securities are going to have to do most of the heavy lifting next year. Those USD denoted players should get a natural tailwind from what has come about from the SoMP and a lower AUD.

The Micro Stuff:

This isn’t new or ground breaking but – Compare the latest earnings releases from JC Penny and Macys’ (even Wal-Mart) to that of Amazon. Bring that forward to Australia and look to what is likely to happen come this time next year.

Myer, Oroton, Premier Investments even JB Hifi and Harvey Norman – those that are not well into the translation to “New World” of retail sales will see the kind of EPS ‘growth’ JC Penny last released.

A 33c decline may have been ahead of estimates but year-on-year actuals do not lie – the structural environment in the US has changed permanently – high cost retailers and outlets are clearly uncompetitive and although there will still be a place for these providers in the discretionary market place – it will be in the minority.

The Amazon story is well known – however, with the festive season (high season) upon us this will be first year new world ‘disruption’ will encroach into traditional retail here in Australia. The first quarter of FY18 was poor and October was soggy and Amazon is only a month old – nothing short of an outstanding Christmas period will do for retail. The question is whether it’s traditional or disruptive that captures the market – February’s half year numbers are going to be huge.

Evan Lucas is an expert guest contributor to Fairmont Equities.

Evan is founder of The Lucas Review. Prior to that he was Market Strategist at IG. He is well known as an expert commentator in finance media such as Sky News Business, ABC1, the Australian Financial Review, CNBC, and Reuters.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!