Are we about to see the first ‘bump’ in the Trump Bump? News from the weekend that the US government entered its first shutdown since 2013 and the first time ever that a shutdown has occurred when one party controls the White House, House and the Senate suggests this event will be the first real headwind under the 45th Presidents term.

The markets where slightly touchy last week on the prospect of a shutdown. Both the DOW and S&P see-sawed throughout the week as the risk of a shutdown was countered by very positive US earnings – Meaning for the first time in years we could start talking about volatility again.

2017 was the first year in the post-GFC era where geo-politics was no longer a mover on the dial of volatility. The VIX managed to wade through: the failed repealing of Obamacare (around March-April), delays to the new Tax Bill (throughout July and August and I would add it is now in effect), specific domestic issues, the Southern Wall funding issues and the President’s twitter account.

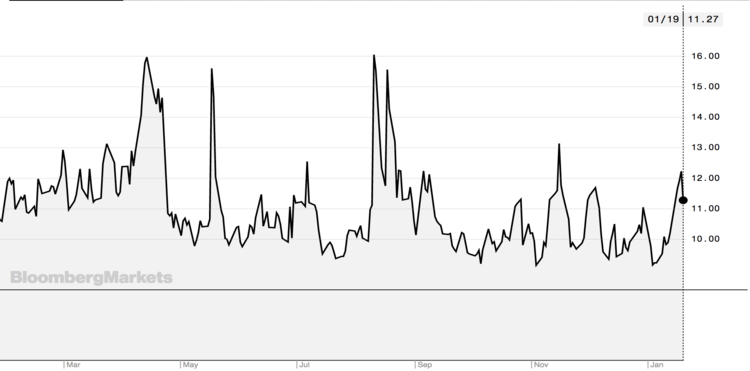

Below is a one year chart of the VIX which shows the peak of 2017 was 16, compare this to peaks of 28 in 2015 and 2016 and 23 in 2014 – markets are clearly looking through risk and any dips were caught quickly as they were seen as a buy opportunity – no one was (is) buying protection.

Saturday marked one year since Trump’s inauguration and clearly this event will be the biggest test for markets since he came into the Presidency. It is estimated that for every week the shutdown remains it will take some US$7 billion out of US GDP. On the current talk – its has been agreed to is public servants effected by the shutdown will be retrospectively reimbursed, however the disruption alone will cause productively loss. Secondly what is currently being negotiated in the emergency meetings on Capitol Hill is a stop gap motion – meaning at best the debt ceiling needs to be completed by February 8 or the States will see its second shutdown of 2018 – The VIX may just reach its highest level in 18 months if this risk event isn’t contained, and that will stretch to global markets.

Washington’s issues are also compounding DXY’s issues

Need to go back to 2014 to see the DXY at 90 it is under enormous pressure – and there is clearly free air on the support side.

The decline in the USD is down to several factors the most notable have been; the growth in other economies, the decreasing probabilities of rate rises in the US versus the increased probability of rate rises by other central banks and the risks associated with the current US bond market rout. Now a government shutdown.

What is also driving of the DXY is the strength in the EUR and JPY both of which have been catching bids heavily in the past 6 to 8 weeks – the JPY due to increased risks in the bond markets the EUR around the zones possible resurgence in 2018.

This view was triggered by the minutes from the December ECB meeting. The release eluded to the prospect of better economic outlooks and that the possibility of raising rates in the area was not out of the question. However, the caveats were that certain market events would need to take place to allow the Bank to consider move in its three main interest rates. Last week saw one of those market events beginning to materialise – inflation.

Core CPI in the Eurozone rose 1.1% year-on-year to December and increased to 0.5% month-on-month.

Europe’s forecasted renaissance in growth this year and should finally break out of the low growth, low inflation, two speed economy it has been shackled with since the GFC and the Euro-crisis of 2012.

This makes Thursday night’s meeting all the more interesting. Further mention of zone’s growth and a return of normality in the periphery should put further bids into the EUR on the belief that 2018 could see the world’s second largest central bank increasing the interest rate for the first time since 2011 – EURUSD to 1.25 isn’t out of the question if this is mentioned. However, already several EU leaders and bankers are concerned by the surge in the currency, the area is heavily reliant on high end exports a hyper-surging EUR will crimp the growth story of Europe.

Evan Lucas is an expert guest contributor to Fairmont Equities.

Evan is founder of The Lucas Review. Prior to that he was Market Strategist at IG. He is well known as an expert commentator in finance media such as Sky News Business, ABC1, the Australian Financial Review, CNBC, and Reuters.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!