Huge week of Macro and Micro data – three central banks, PMIs from all point of the world, GDP prelims, manufacturing data construction data etc. etc. etc.

However, need to point out that Australia actually has the data to watch both from a Macro perspective and a Micro one this week.

Macro Stuff:

Tuesday – RBA Meeting

Although the majority of the country will be tuned into an event at 3pm AEDT (for what it’s worth – money is on Humidor despite the weight he is carrying) as it ‘stops the nation’ don’t forget the event at 2.30pm AEDT.

Keys to the release

- No change to the official cash rate – interbank market continues to drift on a rise in 2018. A 25bps rise is no longer priced in by November, and June is now suggesting there is only a 38% of a rise by then.

- View on US rates and economic outlook – RBA is begging the Fed to raise rates – the AUD needs to shift to ~75c for its GDP estimates to be met

- View on China’s economy – Net export are key!

- Outlook on GDP, inflation and housing

Its current ‘neutral’ stance as under pressure – good possibly it may turn to a slightly dovish position – which will give you 4 days to gear up for the SoMP and possible changes to 2018 expectations.

Friday – SoMP

Will the back end of the year’s data shift inflation expectations for 2018 and 2019? This is the big question – the weakness in the AUD has been down to the fact inflation isn’t materialising.

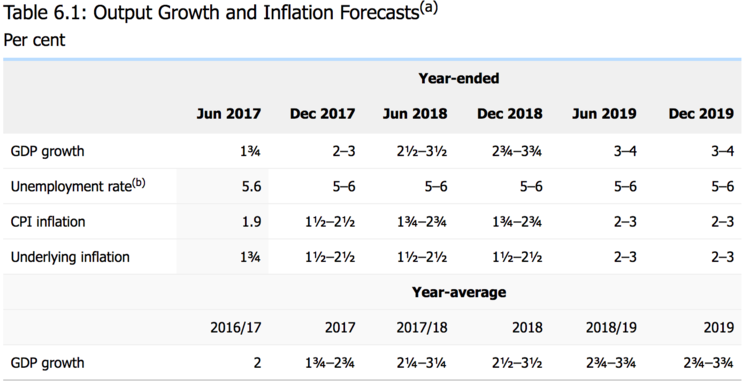

Below is the summary table of the previous estimates from the August release.

Uniquely combining both Fundamental and Technical Analysis

Not yet a subscriber? Join now for FREE!

Receive our weekly tips and strategies into your inbox each week.

BONUS: Sign up now to download our 21 page Trading Guide.

Note that at this release both GDP and Inflation was downgraded a notch (25 basis points or 0.25%).

Considering the inflation read for Q3, signs of a slowdown in housing which has been a large backstop of core inflation over the past 3 years and the fact wage growth is non-existent it could give the RBA reason to shift a notch lower still across the range – which would all but confirm no rate movements in 2018.

I see Friday’s SoMP as the largest piece of data for the whole week.

Wednesday – Chinese Trade Balance

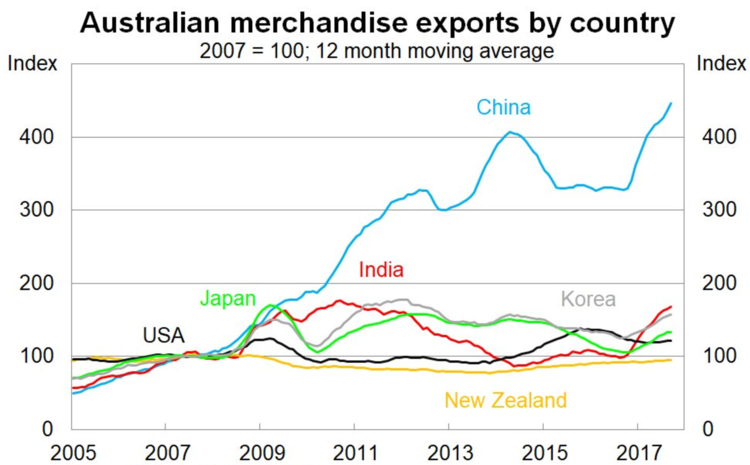

Here is the clearly illustration of Australia’s relationship to China. The expansion of Australian exports to China over the past 12 years shows that any slide in Chinese imports will filter into Australian GDP and trade forecasts.

There were signs at the back end of September/start of October that a slowdown in trade was well underway as the timing of the National People’s Congress (NPC) lead investment decisions to be halted and a concerted effort to slow imports. Import were up 19.5% in September – would expect that to change. However, 2017 has been the biggest year for import into China since 2012 – it is a sign global growth is on the up and China is firing up to absorb the increase.

Micro Stuff

Bank Earnings Season – uninspiring

Westpac crossed the finishing line this morning to end what has been a pretty uninspiring bank earning season.

Here are the key numbers:

- Cash earnings: $8.06bln v est of $8.1

- Net interest margins: 2.09% inline (however its declining)

- Final dividend 94c inline

- BDD $853 million or 13bps of total loans (super low)

Like ANZ and NAB institutional bank is well up 18% (low base for all) while Wealth is underperforming BT Financial was down 11% same story at ANZ and NAB.

With November historical delivering a -2.1% over the past 10 years, the results declared from the banks over the past two weeks is unlikely to snap the ASX out of this trend. Considering it is hovering just under 6000 points and the last test of this level in April 2015 saw 3 rejections. I suspect that November is unlikely to be the month that pushes the ASX through.

December however is a different story – I hear Santa.

Evan Lucas is an expert guest contributor to Fairmont Equities.

Evan is founder of The Lucas Review. Prior to that he was Market Strategist at IG. He is well known as an expert commentator in finance media such as Sky News Business, ABC1, the Australian Financial Review, CNBC, and Reuters.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!