Waking up on Saturday morning and scrolling through my push notification it was like being in a time warp – headline after headline of an intraday collapse from the DOW, S&P and US markets in general – coupled with economic news that was GOOD. There was even a run of -400pts, -500pts DOW DOWN 600pts while right next to this was NFP hits 200K. Like I said it was like a time warp to 2011-2015 when ‘Good News was Bad News” and markets trade as such.

Drilling into Friday night’s trading – the following charts and tables give the perfect illustration of what has transpired and why.

That increase in wage growth is nothing short of outstanding – The conclusion: the Fed’s current outlook on employment is correct if not slightly conservative based on the wage growth figures – Bring out the Hikes!

That left the market scrambling for positioning as rate hikes ON, switch clicked over – the forecasted three rate hike from the Fed in 2018 is now a really possibility rather than a dream.

Here is the reaction in US-10 year Bond – Highest yield since mid-2009

The DOW’s reaction to the data

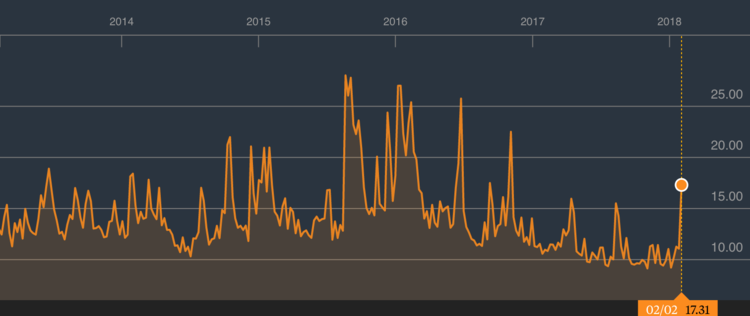

And finally the VIX

The stats from Friday make for interesting reading and will certainly filter into trade today and over the week:

- Worst day for the DOW since October 2008

- FANG earnings and/or outlooks disappointed the market leading to valuation questions and price pressure – Amazon the only one that delivered a good result

- Oil was smashed

- Bond market is now pricing in 2 hikes with the prospect of a 3rd sitting at 42%

- Future markets at a minimum where down 1% come the close on Saturday – mild compared to actually trade – will that hold true?

- DXY was up – however it is still below 90 and at its lowest level since December 2015

How is it that we are back at a point where Good economic news is Bad market news?

The normalisation of monetary policy the world over was always going to happen and has been in translation in the US for over 3 years.

What changed?

Possibly this:

The equity to bond ratio is at a record all-time high meaning equities appear to be ‘overvalued’ compared to the risk-free returns of the bond market. Considering the ‘premium’ compared to historical norms in the S&P’s forward blended P/Es and the fact the VIX is spiking are investors beginning to jump? it’s an interesting point and if liquidity, which is still readily available, tightens up quicker than expected – market shifting is on and on at a much faster rate than previously expected.

Friday hasn’t change my overall views. I am still positive on the ‘Growth’ story of 2018 and see China, Europe and EM snapping this up – However if the US markets react like they did on Friday more ‘consistently’ over the year we could be returning to the Good O’ Bad Days faster than expected.

Evan Lucas is an expert guest contributor to Fairmont Equities.

Evan is founder of The Lucas Review. Prior to that he was Market Strategist at IG. He is well known as an expert commentator in finance media such as Sky News Business, ABC1, the Australian Financial Review, CNBC, and Reuters.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!