Asset classes, intra-markets, geographical trading – all are blurred and a touch mystified as to the state of the global economic outlook particularly in the US – it’s almost like asset classes are at war with one another.

This clouded trading scenario is clouding the outlook however, I retain a strong belief that the synchronised global growth story versus low global inflation is the right view. All current blended data show that this conclusion is coming to fruition.

The European ‘economic renaissance’ is case-in-point. And signals that the ECB’s actions over the past five years is finally creating some traction but more importantly that global confidence is filtering into actual economic returns. The preliminary Q4 GDP read of 2.7%YoY is a very ‘tidy’ input into the growth v inflation view point as European inflation is still flat.

However, despite this macro perspective, market price action is making me sit up and take note – and it’s the reactions to the US inflation data last week that is breaking down normal market relationships and pitting them against each other.

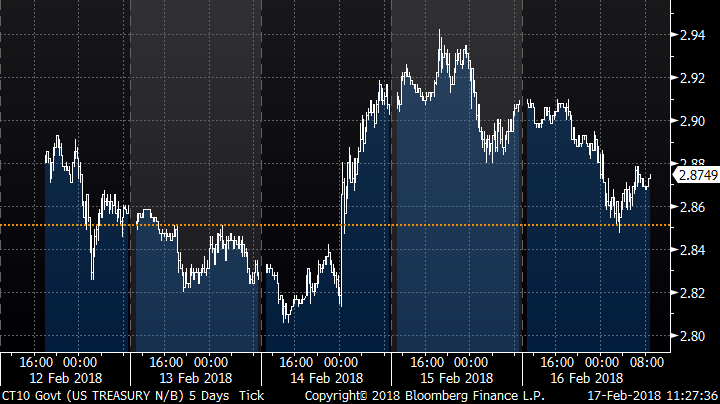

First: Bond traders are clearly the most bullish on future US inflation – shelling US bonds in droves to push US 10-year to a new 4-year high of 2.94% on the release of the CPI numbers. That’s a good 5bps higher than the 2.89% level that has been suggested as a trigger point for the recent equity market volatility that saw the DOW drop 1500 point on ‘Mad Monday’.

The trading shows that bond markets are formulating the view that the Fed is not only going to raise rates 3 times in 2018 but the speed at which it does could be (much) faster – there is also every chance it brings forward one of the forecasted rate rises for 2019 taking this year’s total to 4– The chance the US 10-year will be above 3.5% come the end of September look very probable.

However, US equity markets are looking through the inflation risk and are powering back – The S&P has recovered almost 65% of the correction from two weeks ago. The reaction to the US inflation data was an initial sell off (quite a sharp one actually) but then looked straight through it and powered on.

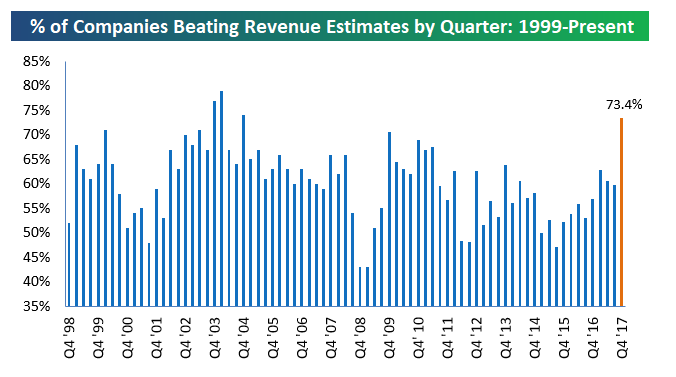

The question here – is this because of the stellar earning season the US is going through? As these two charts show-

Revenue and EPS are smashing all expectations and P/E’s are being revised off the back of these returns – Therefore is equityland nonplussed about possible accelerated rate rises and has instead locked onto the fundamentals rather than macro inputs? Again possible.

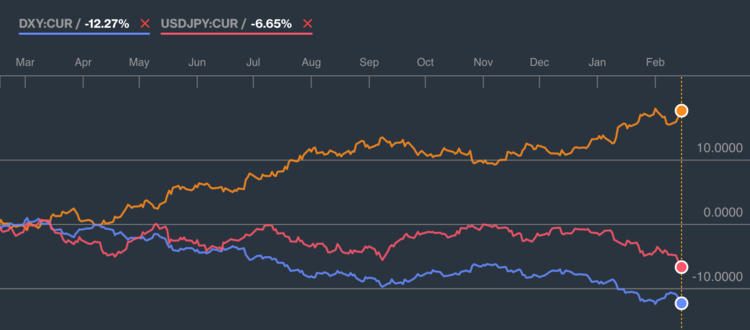

Finally, currencies – and particularly the friendless USD, what is going on? DXY is now sub-88 – here is a comparison of EURUSD DXY and USDJPY.

The EUR is understandable off the back of an expanding European economy. However, even the ECB will be concerned that its increased some 13% in the past three months when really the US economic remains stronger than its Atlantic neighbours and it should be the USD seeing fund flows.

However, its USDJPY that really interesting – why are investors flying to the safehaven currency? Is it insto currency traders asking questions about future fiscal issues in the US budget? Having seen the massive cuts to the corporate tax rate, the smashing of the US debt ceiling and a flood of new fiscal spending (US$1.5 trillion) – leading to a likely debt-to GDP shortfall or US$2 trillion in 2027? Plausible. But the movements in EURUSD and USDJPY have seen DXY getting smashed.

So which is right? Equityland, Bondville or the currencyworld? The normal relationships intra-assets aren’t gelling – let alone across assets classes.

Tricky times – and this week won’t help much either as its Chinese Lunar New Year meaning most of Asia is offline until Wednesday – mainland China is off until Sunday it’s also President’s Day in the US so no leads will be coming from across the Pacific until Wednesday. Mind the market drift!

Evan Lucas is an expert guest contributor to Fairmont Equities.

Evan is founder of The Lucas Review. Prior to that he was Market Strategist at IG. He is well known as an expert commentator in finance media such as Sky News Business, ABC1, the Australian Financial Review, CNBC, and Reuters.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!