Often in the financial media, a talking head or analyst will dismiss a stock as being “too expensive”. Yet often these expensive stocks are the ones that produce the best returns over time. So what does it actually mean when someone states that a stock is too expensive?

The P/E ratio

One of the methods investors use to evaluate a stock price is to calculate its price to earnings (P/E) ratio. This ratio compares the stock price against its per-share earnings. It calculates how much an investor would pay for $1 of a company’s earnings.

The formula is: stock price per share/earnings per share

To calculate this ratio you need the earnings per share. This is found by calculating the earnings from the last twelve months divided by the total outstanding shares.

P/E ratios are useful to compare companies within the same industries together. It can also help determine how the stock priced compared to their earnings.

For example:

Stock ABC share price is $50, earnings per share is $2 (EPS this is calculated by taking earnings of $1,000,000 divided by total outstanding shares of 500,000 shares) so P/E for this stock is $50/$2 = 25X

This is the price investors are paying per unit of current earnings. It also represents the number of years it will take for the company to pay back the amount paid for each share. If the P/E is 25, then the investor is willing to pay $25 for $1 of current earnings. It also can mean it would take 25 years earnings to recover the price paid for the stock.

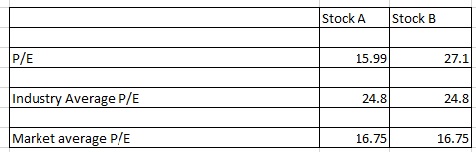

Let’s look at an example of P/E of two stocks as these ratios are more useful when it is compared to its peers.

We can see that stock A is cheaper than stock B as the P/E is lower. Stock B is also expensive compare to the Industry average of 24.80 and it is also expensive compare to the market average P/E 16.75.

What high P/E stocks can indicate?

A high P/E can indicate investors are expecting higher earnings growth in the future and are willing to pay for it now. It can also mean the stock is overvalued. High P/E stocks can also be more volatile.

When to buy high P/E stocks

High P/E stocks often do not well when the economic outlook is shaky. These can be the first to be sold off as investors will rotate out of risky stocks and invest their money in safe havens.

The P/E ratio is a simple way to quickly gauge the value of a stock. Next week in Part 2, we take it one step further by looking at earnings per share and the PEG ratio.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!