Statistics show that three in five Australians feel they do not have enough money to retire. This Mortgage Choice survey also identified that 54 per cent of Australians start planning for retirement when they are over 50 years old. These are alarming figures if you want to retire on a comfortable level.

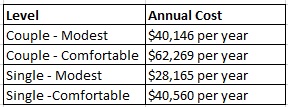

Below is a guideline set by the ASFA (Association of Super Funds of Australia) outlining annual costs involved for a modest and comfortable retirement for those aged around 65. The below table assumes retirees own their own home. To retire on a comfortable retirement, single people will need $545,000 and couples will need $640,000.

The average super balance of Australians in the 65-69 years group is $357,114 and for the 70-74 years group is $282,582. These levels are below what is needed for a comfortable retirement.

In today’s housing environment where there are cohorts of people priced out the market due to record high house prices, retirees who do not own a house on retirement will need even more funds to cover the rental costs.

With house prices out of reach for many Australians and bonds and term deposits generating low returns in this low interest rates climate, investors should consider other alternative asset classes.

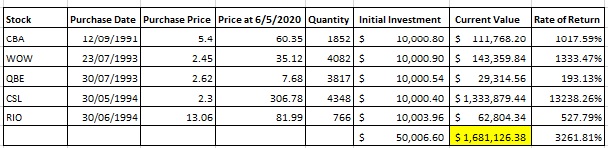

In a simplistic example below, we have provided a table demonstrating an investor who started investing 29 years ago with the purchase of CBA on the initial float. This investor continued to participate in other floats and also brought stocks of household companies over the years. The investor started with a modest amount of $10,000 and accumulated their holdings gradually until $50,000 was invested. From the initial investment of $50,000, this portfolio has a current value of $1,681,126.38 which would be enough for this investor to retire comfortably.

The message is to start thinking of retirement early and don’t delay it until after 50. The compulsory annual 9.5% super contribution may not enough to retire on a comfortable level. Other investments may be needed to make up that shortfall between the balance in super accounts and the lump sum needed for an enjoyable retirement. Alternatively, those who are on track for a modest or comfortable retirement may wish to ensure they have extra funds to enjoy a few luxuries. This is also where early share investing can supplement their retirement income down the track.

Lauren Hua is a private client adviser at Fairmont Equities.

An 8-week FREE TRIAL to The Dynamic Investor can be found HERE.

Would you like us to call you when we have a great idea? Check out our services.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!