This post formed the basis of an article which then appeared in the Australian Financial Review on 19 July 2016. Michael Gable is a regular expert contributor to the AFR. You can access the AFR version HERE.

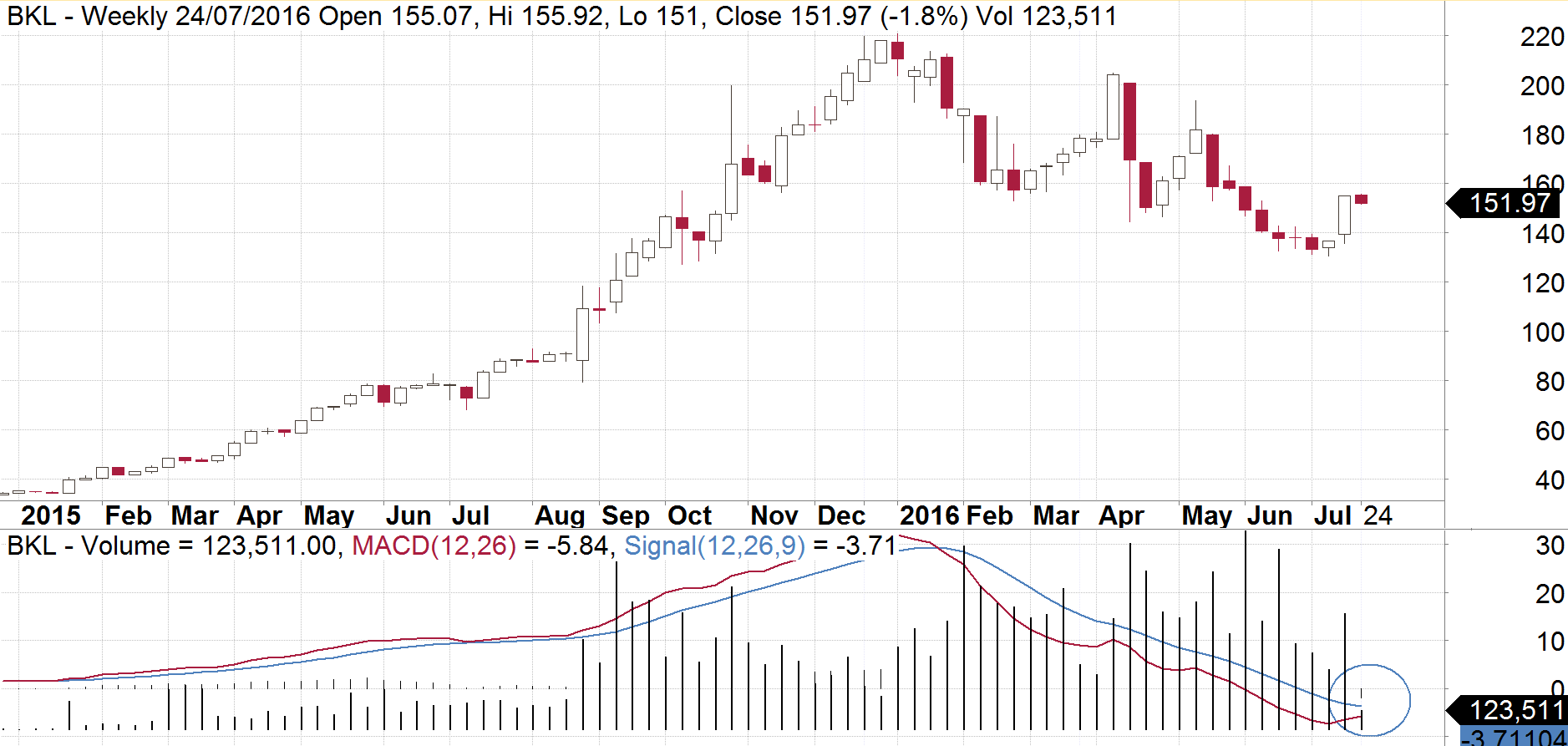

The chart for Blackmores is finally giving us the first buy signals for 2016. Blackmores was the golden child of 2015 as sales to China saw its revenue double in the last two years. Nearly 40 per cent of group revenue comes from China and many analysts are expecting those earnings to continue rising rapidly. This explosion in demand has caused the share price to leap from nearly $30 in early 2015 to about $220 by the end of it. However since then, the share price has headed south. Much of the blame has been on Chinese regulatory risks and profit taking. Having shed nearly $90 of value per share, the question is whether this correction is now over and is the stock now worth buying? Looking at the chart for Blackmores, we have uncovered a couple of buy signals.

On this weekly candlestick chart, Blackmores looks to have found a low here for the time being. You will notice that after rallying strongly throughout 2015, it has since corrected back against that uptrend, dipping towards $130. Having stabilised two weeks ago, it then gapped up last week and finished strongly to produce a very bullish looking candle on the chart. Good volume also came back into the stock during this week. This type of price action is a sign of strength and a “break” from the lows would start prompting investors to step back in and start buying. We can also see the MACD about to cross and give us a buy signal (circled). The MACD is a measure of momentum and this crossing is therefore a sign of this momentum turning around and favouring a renewed uptrend. We can see on this chart that previous crossings of the MACD gave us buy signals near $30 and a sell signal just over $200. If it was to cross again this week, and it looks like we are merely days away from that happening, then we would have our next buy signal for Blackmores. Although I can see upside potential from here, Blackmores should hit resistance near $180. Beyond that, the $200 level would be the next resistance level.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 4 weeks of our client research for free!

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.