The definition of a day trader is someone who buys and sells stocks within the same trading day. Research show that 4 out of 5 people lose money day trading and only 1 in 100 do it well enough to live off the proceeds. A day trader must live off their profits as well as risk their own capital to make these profits. High transaction costs such as brokerage can erode the profits generated from these day traders.

Long term trading also has disadvantages as capital is not used effectively. The definition of a long term trade is a position that is held for many years. With long term trading, you may be holding onto stocks that may be going nowhere as there is no longer significant growth in the business. It might be a better strategy to sell winning trades in the medium term time frame and buying into other new growth opportunities as oppose to holding these positions long term. A medium time frame is a holding period of a few weeks to a few months.

We hold stocks on a medium term basis at Fairmont Equities. We use fundamental analysis to choose quality stocks and then technical analysis to select when to enter and exit the trades. This method maximises your return on your capital as profits from successful trades are then reinvested to purchase other stocks which are still in the growth phase.

See below an example of a portfolio of a long term investor. Stocks chosen are blue chip stocks, stocks which a typical long term investor may hold. Some trades have moved in price, some have been stagnate. Stocks were brought on 13th April 2007- the holding period is 10 years.

From holding these stocks for 10 years the investor has generated a 13.58% return on a $100,000 investment. Most of the stocks have been flat with the exception of CBA.

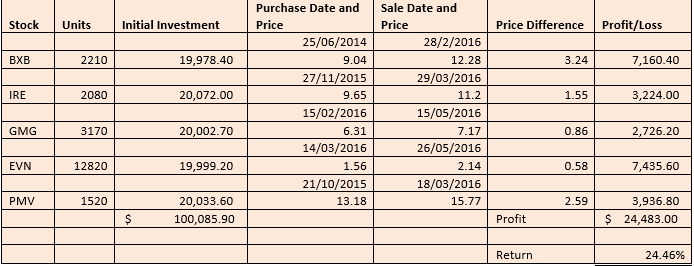

Below is a portfolio of a medium term trader using stocks traded by our clients. The earliest purchase is June 2014 so this investor only has 3 years instead of 10 to generate a return. The investor was able to generate 24.46 % from $100,000 in a period of 3 years. The investor below was able to identify low entry and high exit points to maximise the use of their capital.

The tables above showcase how timing in the market can potentially be more profitable than time in the market. The buy and hold approach may not be profitable if stocks chosen have no significant upward movement.

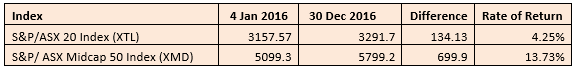

The other consideration is how stocks of different market caps tend to perform over time. Many long term stock holders select stocks in the top 20 however it is the mid cap stocks which have the performed the strongest. See below the table which shows the rate of return comparison between the top ASX 20 stocks by market capitalisation against the ASX Midcap 50 index which are companies within the ASX 100 but not included in the S&P ASX 50. As you can see in a period of a year, the ASX Midcap 50 index has outperformed against the top ASX 20 where performance has been flat. This includes the last two months of the year where the “Trump trade” benefited the top 20 at the expense of everything else. This demonstrates that there is more opportunity to be had if you select stocks which will generate a higher rate of return from the Midcap 50 index as opposed to the top 20.

Therefore it is stock selection as well as market timing which can generate strong performance. An active portfolio trading strategy with medium term holdings allows the investor to cut out poor performing stocks and reinvest in better performing ones. Being proactive ensures you are utilising your capital more efficiently. Holding a position long term may not be profitable if the stock is consistently returning a low performance.

Lauren Hua is a private client adviser at Fairmont Equities.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.