Share markets have done very well in recent months. Are we reaching a top? Whatever your view, share markets will at some stage start to go down again. Most investors know the pain of seeing stock prices trend downward, whether the dotcom bust, the GFC, or any number of corrections that regularly occur each year. In hindsight, these same investors wish they were better equipped with the skills to soften the blow.

In a bear market, the emotion dominating the market is one of fear. Selling activity is high and investors are in a panic. However, there is no need to sell the entire share portfolio. There are still opportunities in the market to make money. In some instances, investors have even made more money in a bear market than a bull market. The reason is because fear is a more powerful emotion than greed.

During the GFC in Jan 2009, CBA shares was priced at $23.94 and they are now $82.12. That is a return 243%. As you can see, there was a lot of selling activity with CBA back in Jan 2009 but the investor who brought the stock at that low price would have made their money over 3.4 times. You might not pick the low of course, but even just being a buyer in that ballpark area would still produce some fabulous returns.

Below are some suggested strategies to take when the market is falling:

1.Short Selling:

The term shorting has been thrown around a lot in the media lately but what does it actually mean? It is a strategy used when investors believe a particular stock price will decline.

An investor sells shares that they do not own (they have borrowed) and then buying back these shares at a later date, returning these shares back to the lender. This investor has the view that these shares will drop so their strategy is to sell the shares at a high price and then at a later date buy these shares back at a lower price.

Short selling steps:

- a) Investor borrows shares from an institution

- b) investor sells this position in the market

- c) When the investor wants to close this trade, they buy the shares back on the market and then delivers these shares back to the lender of the shares. This investor will need to pay borrowing costs associated with this trade.

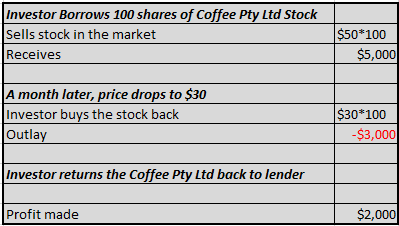

Example: An Investor thinks Coffee Pty Ltd shares will go down in share price. Current Price is $50. He borrows 100 shares from a lender and then sells it on the market. He receives $5000 from the trade. Then a month later, the stock drops to $30.

He buys the shares back for $30 and returns the Coffee Pty Ltd shares back to the lender.

Please note the example does not account for borrowing cost.

2. Purchasing ETFs: There are Exchange Traded Funds (ETF) you can purchase which go up in value when stock market goes down. The benefit of using these is you do not need physically own any shares to short the market. Some ETF available on the Australian market are as follows:

BBOZ – This ETF tracks the ASX 200 and it is geared so if the market drops 1%, this ETF will go up 2 – 2.75%. It also works the other way where if the market increases 1% the ETF drops 2 – 2.75% .

BEAR – This also tracks the ASX 200 index but it is not geared. A 1% fall in the Australian share market will deliver a 0.9 % to 1.1 % increase in the ETF.

BBUS – This ETF tracks the US market, a 1% fall in the S & P 500 will deliver 2-2.75% increase in price of the ETF.

3. Options: You can use different strategies of calls, puts and spread and make money from a falling market.

4. Put in Stop Loss Orders – In a falling market you can use stop losses to limit the amount of cash you arewilling to lose.Once you decide on the level you are comfortable with, the stop loss will automatically generate a sell order in the market when the market price is at your stop loss price. However there no guarantees you will get your stop loss price, once the sell order hits the market, it will fill at the current market price

5. Buy Defensive Assets – Stocks sectors in health, utilities and consumer staples tend to be more stable in a falling market. Consumers will still spend money in these sectors as these are necessities so regardless of the economic environment these companies will still be in demand. These stocks also have stable dividends and earnings.

6. Sell Stocks in the Consumer Discretionary Sector: Stocks in industries such as entertainment, travel, retailers and media usually decline in a bear market as consumers will be less likely to spend money on non-essential items.

7. Buy Value Stocks: Look out for stocks with lower P/E ratios. Investors tend to rotate out of expensive high PE stocks and buy low P/E stocks when the market looks precarious. Value stocks are also useful to have in a bear market as they usually come with dividend when equity growth fade in a weak economy. These stocks would be considered as cheap and good value.

8. Sell the growth stocks: In a bear market, stocks with price-earnings ratios and earnings growth which are higher than the market averages tend to fail in price. These stocks would be seen as expensive and investors may doubt these companies will achieve their future earnings projection in a slump economic market.

All of these strategies, including short selling and options trading, is easy enough to do. We can help you take advantage of these techniques – just ask us how.

Lauren Hua is a private client adviser at Fairmont Equities.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.