This post formed the basis of an article that appeared in the October 2017 edition of the ASX Investor Update on 10 October 2017. Michael Gable is a regular expert contributor to the ASX. You can access the ASX version of the article HERE.

There is a small group of companies in our market that can display defensive characteristics but still go on to grow their profits when the economy improves. Packaging companies might seem a little boring and the products fairly unsophisticated. Cardboard boxes, tin cans, plastic bottles – it doesn’t sound very exciting in a market awash with talk about new technologies and disruption etc, but there is no denying that packaging of goods is essential. In the age of online shopping and Amazon, that can be viewed as a benefit as more consumers look to receive goods via mail than purchased instore. The defensive characteristics are well known, but these companies can also be leveraged to economic growth. Quite simply, as the economy grows, more consumers purchase goods, which increases demand for packaging. Having said that, not all types of packaging products experience the same levels of demand. And like most companies, we need to drill down into the details and judge each company on its merits, beyond just the general demand for the goods that it produces. And what more and more investors are starting to realise in this market, picking the right entry points of stocks can add up to a big difference in your portfolio performance over time. It is something I put a great deal of emphasis on for my clients. Here I take a look at four Australian packaging companies, determine their prospects, and analyse the chart for each one.

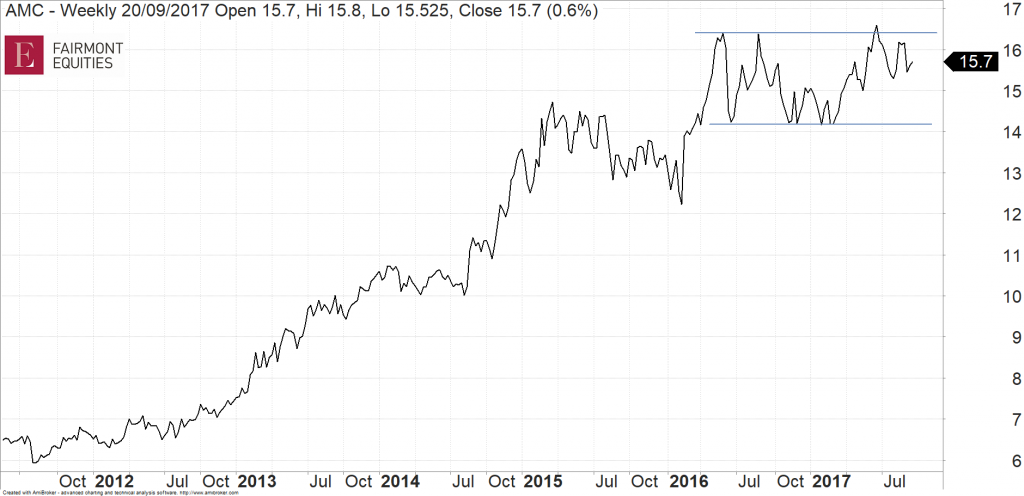

Amcor (AMC)

Amcor is an $18 billion global packaging company. It operates in Australia, North and South America, Europe, and Asia. They manufacture rigid plastics for beverage and food products, as well as flexible packaging for products such as food wrapping and tobacco cartons. Growth in North America continues to look promising and margin performance has been impressive. With 30 per cent of revenue now coming from Europe, the strong Euro has also helped earnings. On the downside, we have seen weak growth in rigid plastics and a soft US dollar. One area that has concerned me in the past is the uncertain performance of Latin America. This area of the business has disappointed in the past with investors selling the shares down by over 10 per cent in the space of a few days last year. However, if economic activity can pick up, then that would be another tailwind for the company.

The chart looks a bit neutral here, so there is no rush to be buying Amcor just yet. Before that savage sell-off in early 2016, the stock at that point was trading at an all-time high. It finally managed to exceed that level in June this year, but has since been sold down again. This price rejection leads me to believe that the stock will go back and retest the recent lows near $14. However, a bit of trendline support exists near $15. This is why the chart is a bit neutral at this stage as the short-term downside remains unclear. Amcor therefore looks like a “hold” at this stage because the long-term direction looks promising, but investors looking to buy the stock may have a better opportunity in the shorter term if they remain patient.

Orora (ORA)

Orora won’t be as familiar to investors as Amcor, as it has only been listed for a few years. But Orora was spun out of Amcor, so it’s a sizeable company with a market cap just shy of $4 billion. Orora is a well-established company focusing on fibre packaging (cartons, cardboard boxes etc) in Australia and distribution in North America. The company is seeing good margin expansion and I expect its earnings to grow well in the future, fuelled by organic growth and recent acquisitions in the US. The company also has plenty of balance sheet capacity. A negative for the company is the high level of the Australian dollar. However, if you take a view that the currency should depreciate, then this would provide an additional tailwind to earnings. Orora is a company that I have traded over the years and still hold for many of my clients.

The chart is a great example of a stock in a sustainable uptrend. After heading up strongly in 2014, the stock then spent much of 2015 consolidating that move. It broke out of that sideways pattern in early 2016 and went on another run. For much of this year we saw it consolidating again, in the form of a symmetrical triangle. Then in August, Orora broke out of this triangular pattern and is right now going for another rally. It is a stock which can be bought on a short-term dip as the longer-term trend is still intact and looking strong.

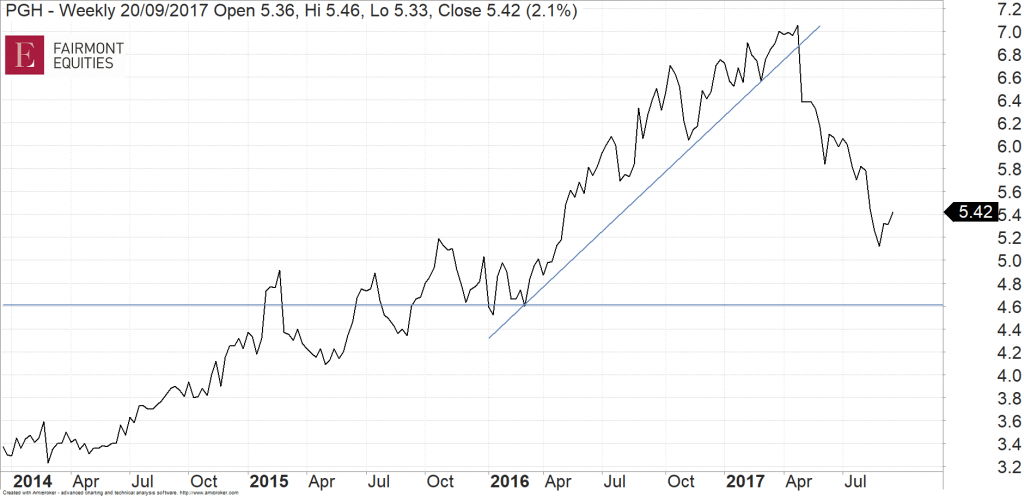

Pact Group (PGH)

Pact Group has only been listed a few years and currently has a market cap of $1.6 billion. Where Amcor is diversified across products and geography, Pact Group is more specialised. The company’s core product is rigid plastics and metal packaging. This is an area that has experienced fairly soft growth this year, as we also saw in Amcor’s results. The company has recently been taking in lower margins on their contracts, and coupled with higher energy costs, the market is currently a bit cautious on their prospects. It is a stock I have been happy to hold in the past but glad we are not holding it now as the last few months have looked ugly on the chart.

Having peaked at over $7 earlier this year, the shares are now trading in the low $5’s, with a P/E of about 14x which is in line with their historical average. I can’t see any support on the chart at current levels for the stock, and that makes sense. The market would not want to pay a premium for the stock until we see a turnaround. Otherwise we would want to see it trade at a cheaper level before dipping our toe in the water. Currently I can see some strong support lower down near $4.60 so that may well be the level that PGH falls to before it becomes interesting again.

Pro-Pac Packaging (PPG)

Pro-Pac Packaging is at the small end of the scale. This $100 million company is well known to some investors by having ex-Australia Post CEO Ahmed Fahour as its Chairman. Pro-Pac Packaging is diversified across manufacturing and distribution, and is involved in both industrial and rigid packaging. The company recently announced a merger with Integrated Packaging Group where they expect to receive plenty of cost synergies and cross-selling opportunities. Mergers can be risky for investors in a stock as proposed benefits may not come to fruition to the same scale and time frame as expected. Pro-Pac Packaging has been trending lower on the chart for the past 5 years. Despite a recent jump in the share price on the back of the merger announcement, the overall trend still looks weak. The stock is in the middle of a trading range here so we would be waiting for the shares to dip back to the lower end before considering it as a buying opportunity.

Michael Gable is managing director of Fairmont Equities.

Sign up to our newsletter. It comes out every week and its free! You can leave your email with us via the form on the right-hand side of this page.

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.

Like this article? Share it now on Facebook and Twitter!