With the Fed hiking up interest rates in the US, it is only a matter of time before interest rate rises take place in Australia. So what are the consequences of interest rate hikes and the stock market?

In general, when interest rates are cut then it causes the market to go up. When the interest rates go up, the stock market goes down. The main reason for this is that companies will have less capacity to borrow more from the banks and less to spend on their business to boost growth. This in affects their earnings and then their stock price.

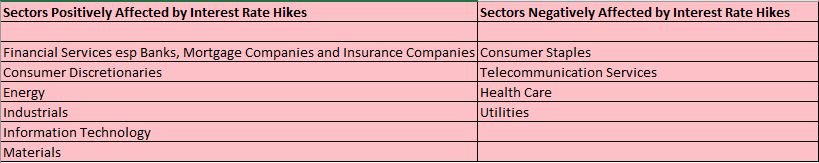

Defensive sectors such as consumer staples, telecommunication services and health care have a negative correlation to interest rates. Utilities also do poorly when interest rates rise. Defensive stocks tend to be in favour in low interest rates environments. Investors tend to move out of regular stocks as they believe these are too risky in turbulent economic times and move into defensive stocks which they perceive as safer. Defensive stocks also offer a higher dividend yield in a low interest rate environment. Utility stocks and telecommunication stocks are unpopular in high interest rates environments as these companies typically have large debt positions which means higher interest repayments. The higher interest rates may also hinder their ability to borrow more funds.

However, there are also some sectors where an increase in interest rates can actually have a positive impact on the stock price. When interest rates go up, banks are affected directly as it now becomes more expensive for them to borrow money. They will pass these charges to their customers so individuals with loans with the bank will see their interest rates increase. Hence earnings from banks tend to increase in times of increasing interest rates and this is reflected in an increase in stock prices. Other areas in the financial industry which benefit from rising interest rates include mortgage companies and insurance companies.

Consumer discretionary can also benefit from rising interest environments. Consumers are likely to spend more money on consumer discretionary products when interest rates rise as it is an indication that economy is strong and unemployment is low. Such consumer discretionary areas include clothing, cars, hotel, restaurants, travel and durable goods manufacturers.

Higher rates would signify an increase in industrial production which would be positive for the production growth. This production growth will directly benefit cyclical sectors such as energy, industrials and information technology and materials.

A strong economy is likely to boost capital spending which is a positive for IT shares. Companies usually invest more in new infrastructure when the economy is in a positive state. IT companies also tend to not have very high debt positions so rising interest rates will not affect the as much.

To conclude a rise in interest rates is usually bad for the stock market but even under higher rate environments, there are still good stock performers in the market.

Lauren Hua is a private client adviser at Fairmont Equities.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.