This post formed the basis of an article that appeared in the November 2016 edition of the ASX Investor Update on 8 November 2016. Michael Gable is a regular expert contributor to the ASX. You can access the ASX version of the article HERE.

At any one time, there are a few different themes running in the Australian share market. Get some of these themes right, and you can do well with your investing. Some examples of themes in the last few years include the decline in oil and iron ore, the falling Australian dollar, and the rise of the healthcare sector. One of the major themes for the last few years has been the yield trade. Declining interest rates across the world have seen a flood of money search for stocks with a decent, reliable yield. These stocks have been bid up higher and for longer than expected. REIT’s, infrastructure, banks, and Telstra have all been treated as “proxy bonds” by investors. As the buying continued, the yield (the dividend as a percentage of the share price) naturally has come back to lower levels, and the P/E ratios have been hitting numbers which scream out “expensive”. Reports of the demise of the yield play have been greatly exaggerated in the past, but we could be seeing the beginning of the end for this theme. Great profits have been made in riding this wave, but we are seeing the first signs of it coming undone. Economists are starting to shift their outlook on Australian interest rates from one of “lower for longer” to one where rates are staying on hold or even heading up in 2017. In the last few months, Australian 10 year yields have risen by nearly 20 per cent, indicating that bond markets are starting to factor in a world of rising interest rates. In my opinion, investors are already preparing for a US rate rise, and this means that the yield trade will start to unwind. It won’t happen overnight, and there will be some dead-cat bounces along the way, but this will be a major theme that investors need to make sure they are on the right side of. There are many stocks that have benefited from this theme but I have already started repositioning my clients away from the yield trade. For the ASX Investor Update this month, I will share with you my views on four of the most popular stocks in the yield trade – Commonwealth Bank (CBA), Telstra (TLS), Sydney Airports (SYD), and Transurban (TCL). To be a successful investor, not only should you look at macro issues and company fundamentals, but you also need to apply some good technical analysis. Here I will look at the charts for these four stocks.

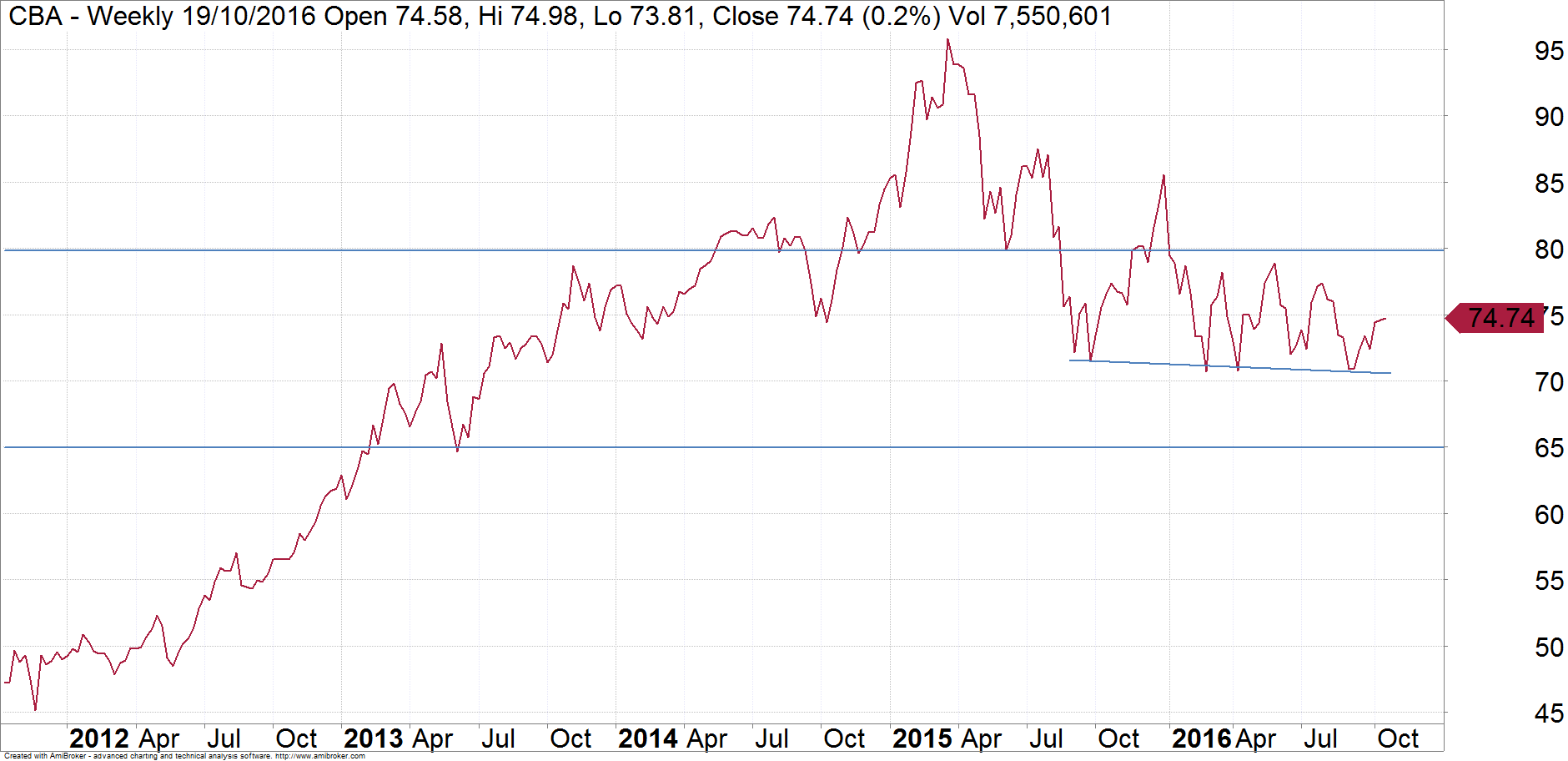

CBA

From 2012 to early 2015, CBA went on a fantastic run and saw its share price double during that time. It was clearly a beneficiary of the yield trade, but its peak occurred over 18 months ago. This was during a period of time where interest rates in Australia were still on the way down. So we cannot blame its slide on the recent phenomenon of the yield trade ending. Banks are not as expensive as some of the other sectors out there and there will be some benefits to them from slightly higher interest rates. This means that as a yield trade, they will be more resilient than others. Looking at the chart, we can see that the $70 region has offered some strong support during the last year. However, it is not making any higher highs and the volume during the last month has been fairly weak. Sometimes the more you test a support level, the more you weaken it. I would be wary of another move back towards $70 as this could lead to a break under it. And a break under it could trigger some stop losses and some further selling, and this may result in a brief spike down towards $65. This would represent a fantastic buying opportunity. Otherwise if we see CBA climb to $80 and hold that level, then that would be a very positive sign. At the moment however the shares in no-man’s land.

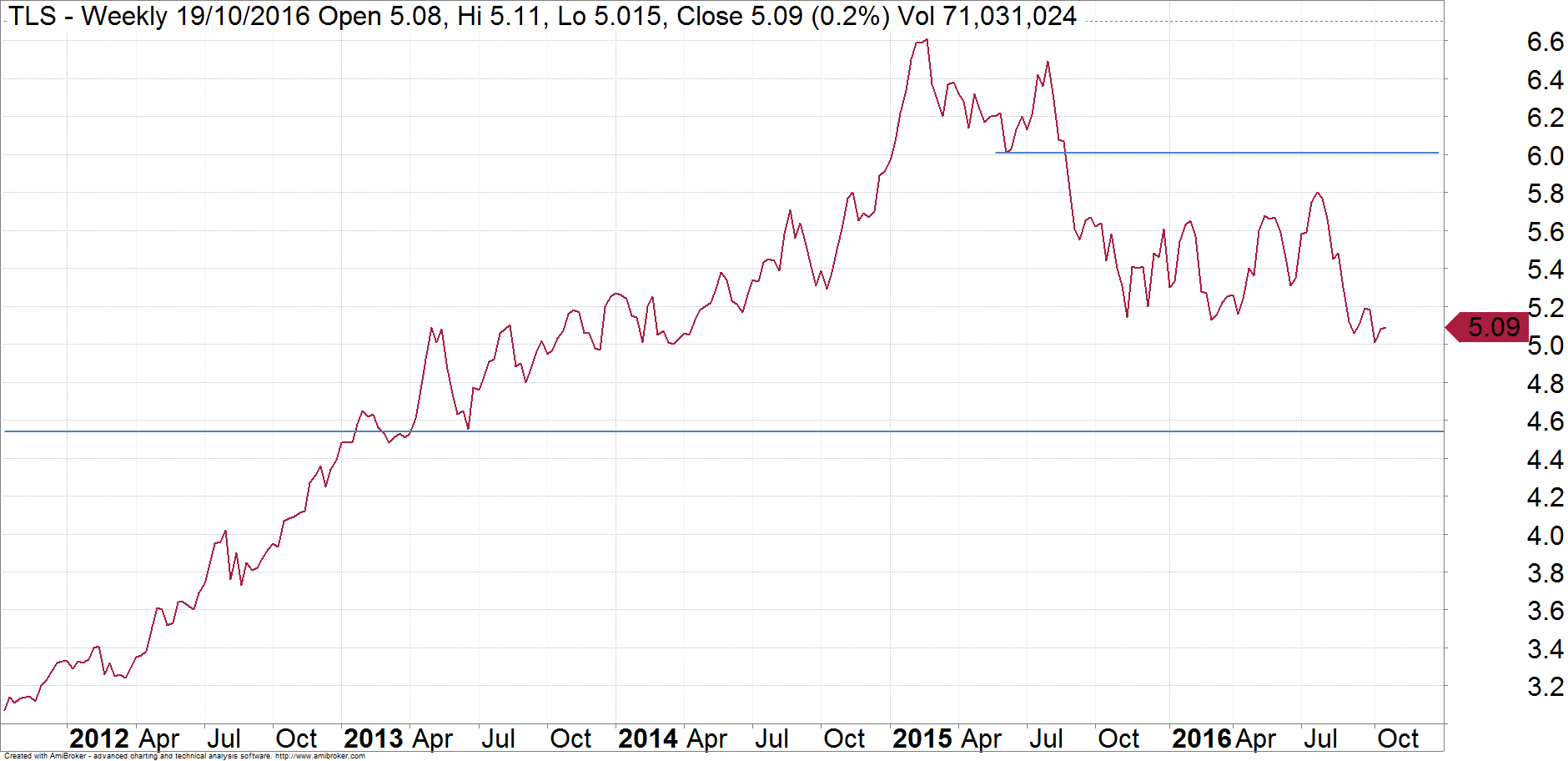

TLS

As CBA peaked in early 2015 so too did TLS, reaching levels not seen since 2001. When it reached its 2016 high in July this year, it became obvious to me that TLS was going under $5. By reversing under the $6 level, it was on course to make what is known in Elliott Wave analysis as a “5 wave decline”. Although it has already now achieved my initial target of trading under $5, I can see recent weakness on the chart to suggest that there is further to go. I would expect levels as low as $4.50 to be achieved during 2017. TLS has a growth problem and the main attribute propping it up is the yield. As the yield trade unwinds, the lack of growth means that the share price will make little progress during the next year or so.

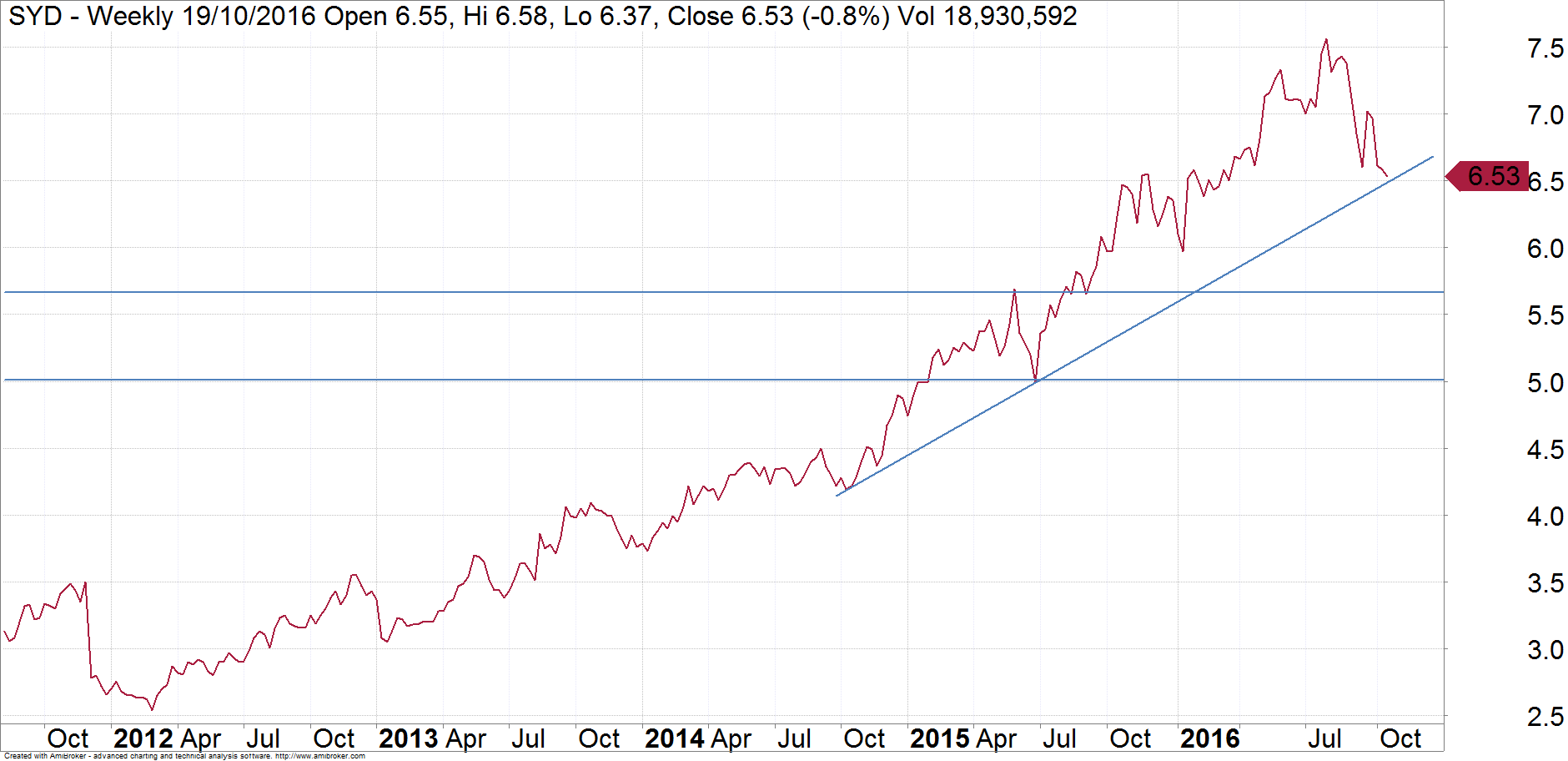

SYD

From 2012 to its recent high, SYD managed to see a 3 fold increase in its share price. It is a quality company and the yield is reliable. This helps explain the stellar rise in an environment of lower interest rates. However earnings growth is starting to moderate and combined with the prospect of higher rates next year, the stock has taken a tumble. At time of writing, the shares are sitting at trend line support, but the severity of the drop and the volumes are causing me some concern. I would expect lower levels to eventuate for SYD before I consider it a buying opportunity again. I can see some support near $5.70 which is where the shares are likely to head to. If that cannot hold, then the low $5’s would be a worst case scenario.

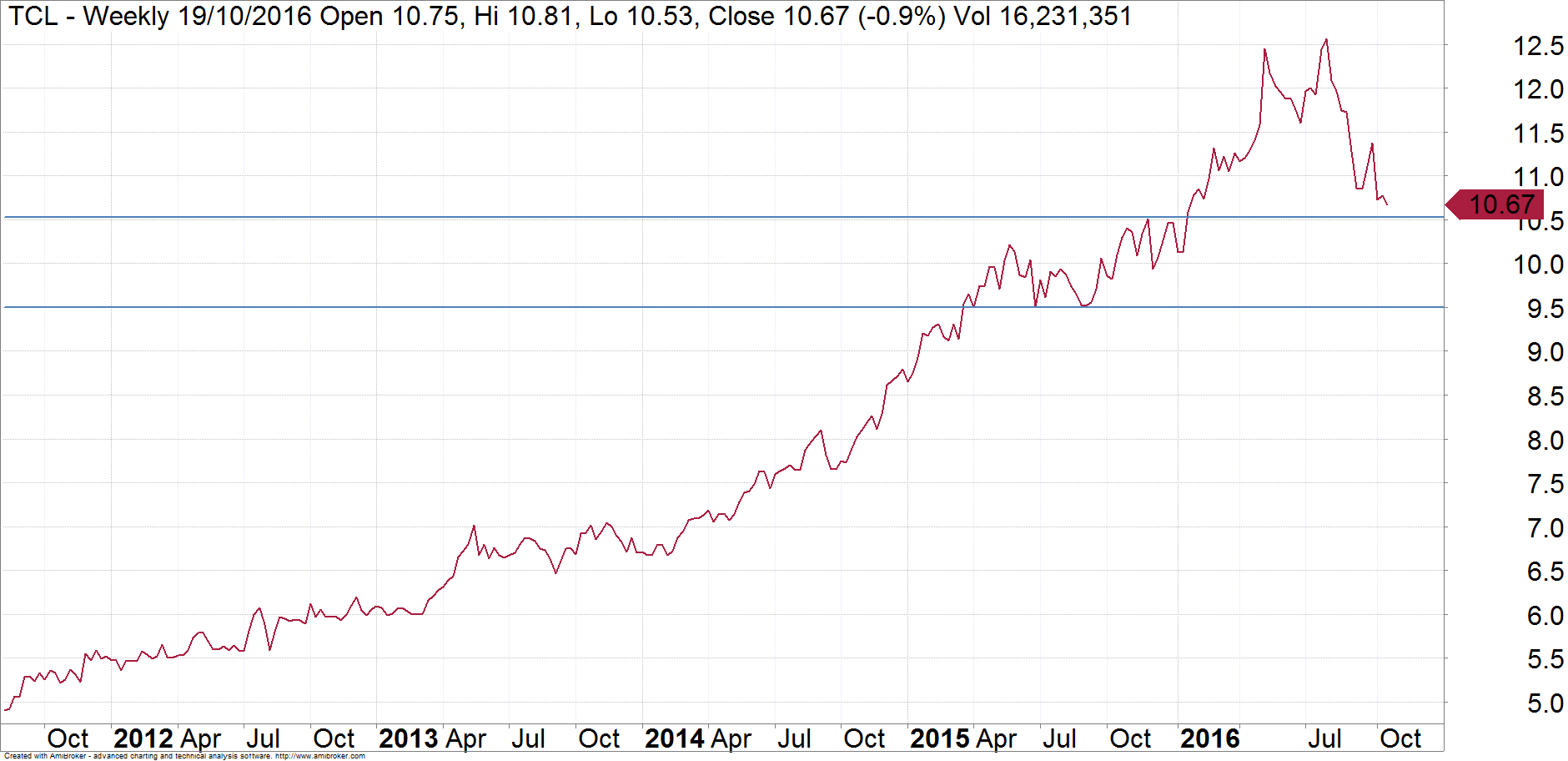

TCL

TCL is similar to SYD in some respects in that it has a defensive profile with reliable earnings. And like SYD, its peak was recently in August this year, and the sell-off since then has been fairly savage. Infrastructure stocks tend to have high levels of debt so increasing interest rates can concern a lot of investors. Price action also suggests that we are likely to see lower levels for the stock during 2017. There is some good support near $10.50 for a short term bounce but ultimately we can see levels as low as $9.50 as any rallies are likely to be sold into.

Identifying the yield trade has been a profitable theme to hitch your wagon to. However, it is starting to unwind and investors need to be cautious. In some instances it is now time to jump off. Some beneficiaries of the yield trade are likely to stay well supported though, such as the banks. My philosophy to investing is to combine both fundamental and technical aspects and these charts show that lower levels are possible for some of these shares.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email Michael Gable directly at michael@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.