There has been talk of a housing bubble for many years now. With households highly leveraged, a significant increase in interest rates or high unemployment may have dire consequences on borrowers’ ability to repay their mortgage. But if there was a housing crash, how would this affect our stock market?

Firstly, we are not predicting a crash in house prices. However, it is smart to be aware of the ramifications, if indeed there is a severe downturn. This means we can be well placed to take advantage of the opportunities that may arise.

A housing crash will decrease the home values if home owners are unable to pay off their mortgage repayment and a mass of foreclosure sales hit the market. This may lead to a recession which means consumers will have less money to spend on goods and services and this will slow corporate growth. This is the primary effect of a housing market on the stock market. Companies which rely on consumer spending will see a decrease in earnings and this will also decrease the share price.

The real estate sector creates jobs in the housing construction sector. Therefore, while we have a thriving housing environment, we can continue to employ people in these jobs. The construction industry employs 8.9 per cent of all those currently employed. If there was a decrease in housing construction, it will increase the unemployment rate. If unemployment rises, spending consumption will also decrease.

A housing decline will also affect households not employed in the housing sector. The net wealth of households will decrease if housing prices decrease. Therefore, the amount of equity homeowners can extract from their homes will be reduced. This will further limit their ability to spend money. Banks may tighten their credit requirements on loans and may ask for larger deposits for home loans. Home buyers may need to liquidate their stock positions to facilitate this. We may see increase selling activity in the stock market for that reason or investors may liquidate their positions to get quick access to cash.

Industries which will be directly affected are financial services, home building companies, home improvement companies, furniture manufacturers, durable goods. Banks will take a hit from the bad loans. Stagnate growth in the housing market which affect all property stocks and property home improvement stocks. Property development and renovation will not be as popular during a housing collapse. Consumers will be less willing to buy expensive items such as white goods and expensive handbags.

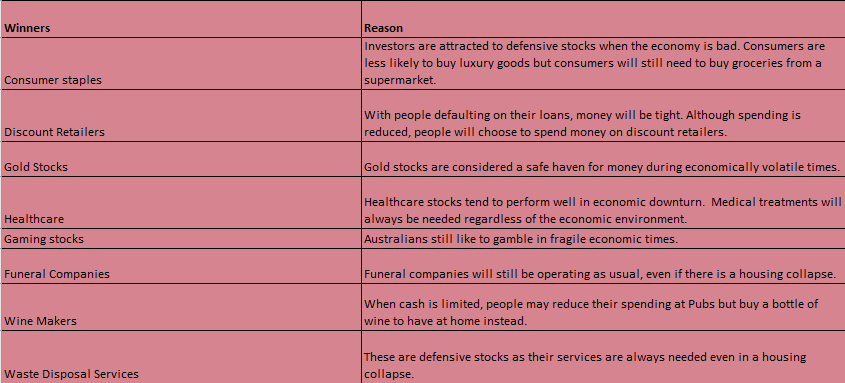

Not all stocks will suffer in the stock market. Some may actually benefit from a housing collapse. Defensive stocks are usually popular during an economic down turn. See the list below of losers and winners of a housing crash.

Lauren Hua is a private client adviser at Fairmont Equities.

Make sure you bookmark our main blog page and come back regularly to check out the other articles and videos. You can also sign up for 8 weeks of our client research for free! Otherwise you can email us at mail@fairmontequities.com

Disclaimer: The information in this article is general advice only. Read our full disclaimer HERE.